“Any system created by the human mind, Can be hacked by another person’s mind.”

Stephen King

Surely many traders working in the cryptocurrency market have heard about currency arbitrage (which should not be confused with traffic arbitrage) and nurtured the idea of making transactions using one or another arbitration system.

In this article, we will try to understand the concepts, consider several obvious (and not so obvious) arbitration systems, and also analyze the risks and take into account possible pitfalls of such operations. Let’s start with the definition.

Arbitration (from the French “Arbitrage” is a fair decision) is several logically related transactions aimed at making profit from the difference in prices for the same or related assets:

- at the same time in different markets – spatial arbitration,

- in the same market at different points in time – temporary arbitration.

Spatial arbitration

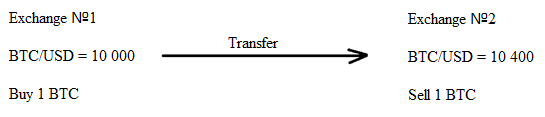

Speaking about market arbitration in the narrow sense, first of all, it is necessary to keep in mind spatial. The mechanism of its action in the simplest words is: quotes on 2 different exchanges are very different. Accordingly, buying an asset on the first exchange at a lower quotation and selling on the second at a more profitable one, will get us our profit.

At its core, exchange arbitrage is the exploitation of the inefficiency of quoting an individual broker / exchange or the financial system as a whole. The less centralized the financial system, the worse the over-the-counter communications are established, the better for the arbitrageur.

That is why arbitrage operations with cryptocurrencies are currently quite relevant today. Let’s move on to the specifics and analyze some arbitration systems and analyze their features.

1. Inter-exchange Arbitration. System # 1

We return to our simple example with the difference in quotes. On exchange No. 1, the quotation BTC / USD = 10,000, on exchange No. 2, the quote = 10,400. We buy on exchange No. 1 (in the ASK column), transfer to exchange No. 2 and sell there (in the BID column), we get gross $400 profit. For this difference between executable orders of 2 positions on 2 crypto exchanges, we introduce our concept and call it the inter-exchange spread.

Transaction costs

It would seem that everything is quite simple. However, $ 400 in our example is called a “gross” profit. In fact, we will get less and sometimes significantly less “net” profits. Why? The answer is simple: due to various commissions:

- transfer of funds from an external wallet to exchange No.1;

- some exchanges (for example, HitBTC) charge a deposit fee;

- transaction fees on the exchange No. 1 (purchase of BTC);

- transfer between exchanges No. 1 and No. 2;

- transaction fees on exchange No.2 (sale of BTC);

- withdrawal of funds from exchange No. 2 to an external wallet.

Given the large number of such transaction costs, arbitrageurs usually work with an over-the-counter spread of 2-3% and higher, and also work out various transactional structures to reduce commissions.

Liquidity problems

Liquidity is one of the most important points to consider in arbitration. Often, a large inter-exchange spread appears on low-liquidity altcoins, the trading volumes of which are very small, so it’s simply not possible to crank out large amounts. And professional arbitrageurs work precisely on large volumes in order to reduce transaction costs.

Also, do not lose sight of the fact that quite a lot of players are trying to get an arbitrage gain, and if there is a clear bias, any amount will be closed quickly enough. A sample of the volume means the redemption of orders interesting for arbitration from the stock market. As a result, the arbitrageur loses profit due to changes in available quotes.

Quotation Risk

All actions for spatial arbitration must be carried out practically (and preferably literally) at the same time, otherwise the quotes will change, the exchange-based spread will change, and the operation risks become unprofitable.

All actions for spatial arbitration must be carried out practically (and preferably literally) at the same time, otherwise the quotes will change, the exchange-based spread will change, and the operation risks become unprofitable.

In the example we are considering, this risk mainly arises at the stage of transferring funds: from one exchange to another; from an external wallet to an exchange. A delay may occur on the part of the exchange itself – due to technical work, the crypto asset wallet may not work either for replenishment or for withdrawal. Some exchanges provide real-time information about this.

Also, the risk increases with a heavily loaded cryptocurrency network and slow transaction processing. Even though the commission for conducting transactions on the Bitcoin network is relatively small, the withdrawal will take at least 10 minutes (the time for the formation of a new block). For this reason, the Bitcoin Core network is poorly suited for this type of arbitration; a faster blockchain is needed for transferring funds.

Algorithmic trading

By the degree of automation of arbitration operations, several categories of traders can be distinguished:

- manual / semi-automatic trading. The bulk of this is how beginners work, or a new transactional system is being tested. The efficiency of operations is quite low. Often, special resources, paid / free software, telegram bots are used to search for arbitrage positions, sometimes the exchange itself provides information;

- algorithmized arbitration. It is much more effective if all arbitrage operations are performed by a bot / program. It is highly advisable to write such a program yourself, rather than buying a finished one, only in this case you can achieve maximum efficiency and be able to make the necessary changes. Also, the exchange must support / provide an API so that the algorithm can be embedded in it.

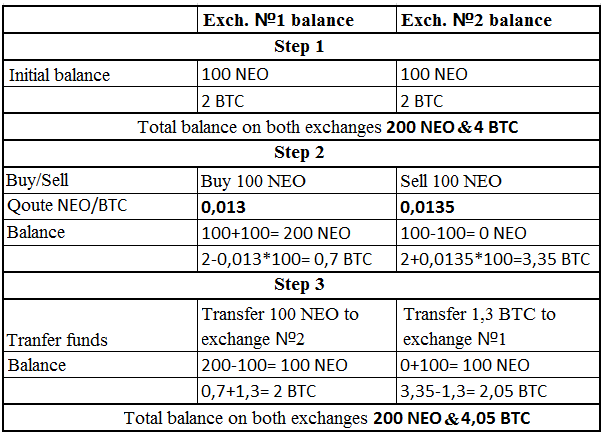

2. Inter-exchange Arbitration. System # 2

The main problem of inter-exchange arbitrage under the first system is the need to quickly transfer funds from exchange No. 1 to exchange No. 2. Let’s try to eliminate this component. The second system will be effective in investing assets in the medium to long term.

Suppose we have 200 NEO altcoins and 4 Bitcoins that we store on 2 crypto exchanges in a ratio of 50/50 to diversify risks (see table STEP 1). When an over-the-counter spread appears, we buy NEO (at the expense of BTC in the wallet) on the first exchange and completely sell them on the second (see table STEP 2), after which we make 2 transfers from exchange to exchange to restore the balance (see the table STEP 3):

In this example, we will not factor transaction costs again (but we certainly need to remember them). So, in our case, the “gross” arbitrage profit was 0.05 BTC.

Now about the disadvantages of this system:

- immobility – we are tied to 2 specific exchanges and look forward to the appearance of an arbitrage situation. Therefore, you should carefully choose the exchange.

- increased transaction costs: it will be necessary to complete 2 operations of transferring funds from one exchange to another in order to restore the original 50/50 proportion and close the cycle of operations.

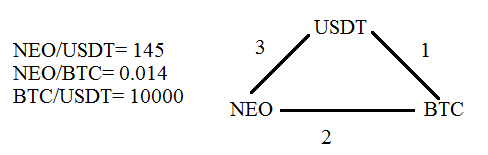

3. Inter-exchange (triangular) arbitrage. System # 3

The possibility of inter-exchange arbitrage arises when quotes are ineffective within one platform. Suppose that the following situation regarding asset quotes arose on the exchange, and we have at our disposal 10,000 USDT:

- 10 000 USDT to 1 BTC,

- 1 BTC to 71,43 NEO,

- 71,43 NEO to 10 357 USDT.

Thus, the “gross” arbitrage profit is 357 USDT at the current ratio of quotes.

The chain of intra-exchange arbitrage operations may not be limited to 3 assets, but may be longer and constitute, for example, 4 or more assets.

The disadvantage of this system is the increased risk of changing quotes. Thus, for efficient operation, full automation is needed to search and execute applications. It is worth considering that some exchanges introduce an additional delay (delay) up to several seconds for processing market orders using the API, which can significantly affect the final result.

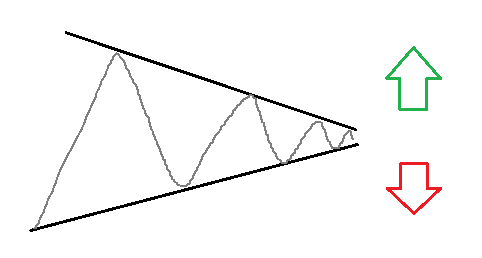

4. Trade / market (risk) arbitration. System # 4

This system largely depends on significant events and impulse movements in the market, as well as on the ability to predict trend movement. When trading on the foreign exchange market, a similar event may be, for example, the publication of macroeconomic data (NFP every first Friday of a new month or the rate of the US Federal Reserve). Graphic figures such as a triangle, when broken, are equally likely to cause the quotes to move up or down, and it is also likely to be impulsive:

For system No. 4, it is necessary to use 2 cryptocurrency exchanges that allow margin trading (for example, Bitfinex and Poloniex), since we need the ability to open sell positions. On one exchange, we open a position for growth, on another for a decrease before the moment of the breakout of the figure. Positions must be collectively market neutral, that is, the collateral, margin security, and opening quote are identical.

These options for closing a position are available:

- without placing pending orders. Closing a losing position when reaching a Margin Call / Stop Out values;

- setting pending orders (Stop Loss / Take Profit). Closing at given quotes.

Closing one of the transactions (partially or completely) with a loss, we get profit from the second position. The difference between them is our arbitrage profit.

This method of arbitration is not recommended for beginners, as it’s necessary to correctly select the Money Management strategy and the position size in relation to the size of the market movement that we plan to trade. Do not forget that margin collateral on some exchanges is provided through the depositing of cryptocurrency, with the condition that you will need to pay a percentage.

The main disadvantage of this system is the trading risk. It includes possible slippage in order processing, knocking out at a Stop Loss on one or both positions in a hyper volatile market, etc. Also, not all assets can be traded with margin collateral, their number is limited.

Interim arbitration

What is temporary arbitration? This is a type of arbitration, which involves making a profit in the same market at different points in time.

5. Spread arbitrage (synthetic position). System #5

To trade using this type of arbitration, we also need margin trading and the ability to trade a sell position. Consider this arbitration scheme using the example of the BTC/USD(T) asset.

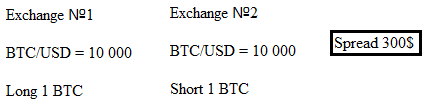

Suppose that on one exchange the quotation is BTC / USD = 10,000, and on the other 10,300. On the first exchange, we open a buy position, on the second – for a sell with the same volume:

The aggregate position will again be market neutral, that is, if the BTC / USD rate changes, the profit of one position will be equal to the loss for the other (subject to the same volume and margin).

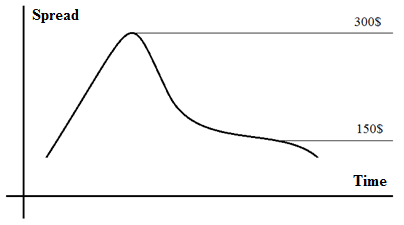

What are we making money on here? The fact is that the spread is not a constant and, in this case, a change in quotes plays into our hands. Having fixed the spread at $ 300, we wait until it changes to the value we need (for example, up to $ 150) and after that we close all positions.

How it looks in numbers:

- We open two positions with a spread of $ 300: we buy BTC / USD on Exchange No. 1 at a price of $ 10,000 and sell BTC / USD on Exchange No. 2 at a price of $ 10,300.

- We close both positions with a spread of $ 150: on exchange No. 1 we fix the price of $ 10,500, on exchange No. 2 we fix the price of $ 10,650.

Total financial result: (10 500 – 10 000) + (10 300 – 10 650) = $ 150

Cons of this scheme:

- the aggregate position will be market neutral, however, with great volatility, we must be able to survive a strong change in quotes for the duration of the trade. This requires very competent Risk & Money Management.

6. Arbitrage spot futures. Calendar Spreads. System #6

The arbitrage spot futures system provides for the purchase of an asset on the one hand and the sale of futures for the same asset on the other. Typically, futures prices are slightly higher than their spot prices, and you can make money on it. It is believed that as the futures expiry time approaches, its price approaches the price of the underlying asset. Thus, the spread between the spot market and the futures can also be earned. For this type of arbitrage, you can use, for example, settlement futures on CME and deliverable futures on Bakkt.

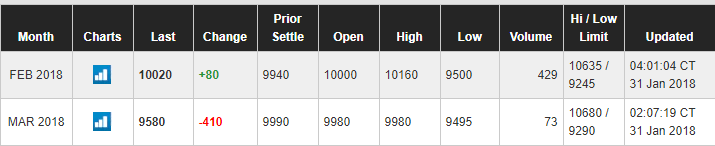

At the same time, it is now possible to trade calendar spreads between two futures contracts. Suppose that the following situation appeared on the market:

We can buy March futures and sell February, fixing the calendar spread between them. According to the meaning and logic of trading, it fully complies with the previous arbitration scheme, only in the futures market. Next, we wait for the narrowing of the calendar spread and close the position.

Conclusion

In this chapter, we have examined several arbitration systems and proceeded from simple to more complex. In reality, there are many more such schemes, for example, pair trading, which allows you to earn income by changing the correlation of 2 assets.

Arbitrage operations are certainly of interest, especially in such an emerging market as cryptocurrency. They allow you to get a small income with relatively small risks due to the inefficiency of quotation. To extract significant benefits, you will need a large deposit, a deep understanding of the market and programming skills to create / maintain an arbitrage bot.

At the same time, you need to understand that, while providing opportunities for such earnings, the young cryptocurrency market also has an increased exchange risk (hacks, closures of cryptocurrency exchanges), but with time the situation is likely to change.

Read more

https://fortraders.org/en/forex-education/crypto/srypto-market-manipulation.html

https://fortraders.org/en/forex-education/crypto/what-is-a-token.html

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold