There is a remarkable trend in the currency market. The EURUSD volatility weakened last year to levels never seen before in the single currency 20-years history. The low fluctuation of the FX market is a sign of equilibrium, where the euro and dollar are on one side, and “yielding” EM currencies – on the other.

The dynamics of the British pound have also left the front pages of the daily reports of the most significant market movements, while GBPUSD for the previous two months can not pull itself from 1.3000.

But at the same time, the dynamics of the euro to the pound is worth a separate mentioning. EURGBP reached its 10-year peak levels above 0.9300 in August on a wave of fears of chaotic Brexit after Boris Johnson came to power.

However, the new Prime Minister quickly moved the negotiations from the dead end, and managed to strengthen the party’s position in the Parliament. This gave carte blanche to pass laws without looking back at the coalition. As side effect, GBP soared to its peaks.

The growth of the pound was the most noticeable against the euro. In the EURGBP pair, the 10-year highs in August were followed by 3-year lows below 0.83, indicating 11% growth of the pound against the euro in just five months.

During the last weeks of the 2019, the pound experienced some decline, but for the most part, it associated with a correction in traders’ positions after the impressive rally. This week, the pound stood out brightly against both the dollar and the euro once again, recovered some positions.

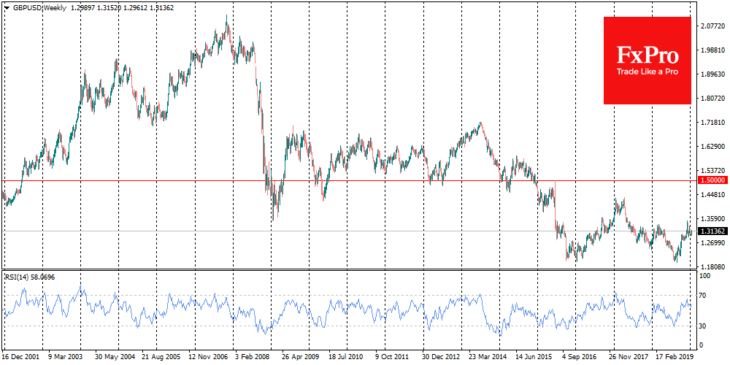

The historically low rate of the British currency against the dollar increases the competitiveness of British exports, which supports the labour market and sales. Besides, the weakness of the pound creates inflationary pressure in the country, limiting the Bank of England to cut rates, following the example of Europe and the US, while the relatively smooth process of UK’s exit from the EU removes a significant part of risks from the market.

If there are no unpleasant surprises from Brexit, it may be quite logical for the pound to recover further against the euro.

From the side of technical analysis, the drop at 0.8300 will open the doors for EURGBP to the area of 0.8000, near which the pair consolidated in 2008, 2011 and 2014.

For the GBPUSD pair, the medium-term attraction area may be above 1.5000, where the pair was comfortable from 2010 to 2015.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold