Looming tariff war constraints mainly through risks of slowing consumer spending in the United States and China are forcing them to actively search for alternative pressure points of each other. And if the US decided to go by “abusing the doctrine of national security” (as China calls it) and use this pretext to add some Chinese firms to the black list, then China, in addition to symmetrical measures can also consider manipulating with its huge portfolio of US government debt. But how big is this threat to the United States?

PBOC’s large scale selling of US Treasuries is considered to be an unlikely event, since, firstly, it will lead to a fall in the nominal value of its own assets on the balance sheet. Despite the fact that the US government debt market is one of the most liquid bond markets, its capacity is not unlimited – it will not be able to absorb a sharp increase in supply quickly enough so that other market participants do not have time to use the powerful sell signal. One such attempt to derail the market can cost PBOC very expensive. Secondly, a significant oversupply of bonds will lead to an increase in interest rates in the US economy, pushing the conflict into unchartered waters. Unknown impact on US and exact retaliatory measures will be the main source of uncertainty for China in this case.

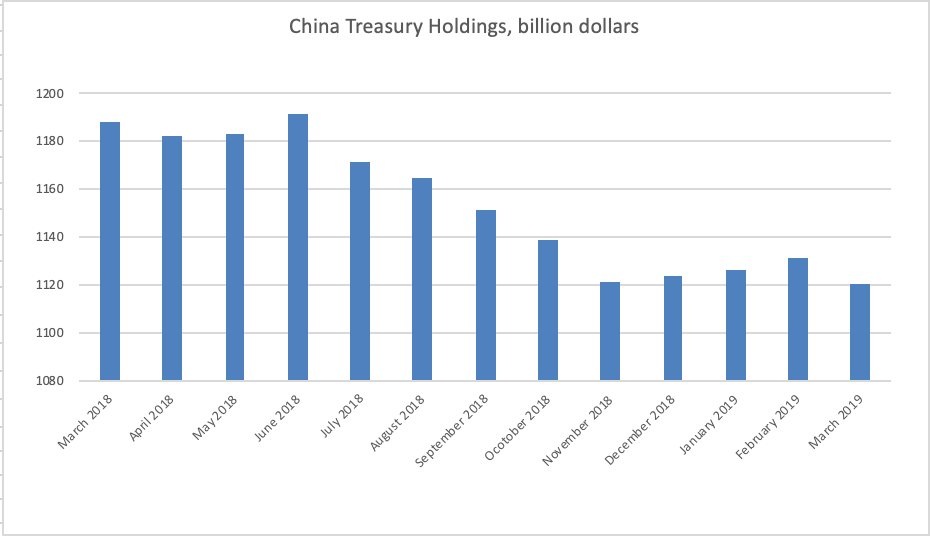

China has been reducing its US Treasury bond portfolio slowly and in a sneak manner, which, coupled with a record sale of bonds at auctions to finance new borrowing, barely made the Fed worry about the acceleration of interest rate growth.

About 10 years ago, China became the largest foreign owner of the American debt ahead of Japan. In March 2019, China’s investment in US T-bills fell to 1.12 trillion dollars, while Japan held a little less – 1.08 trillion dollars. The highest amount of China’s investment in American debt reached 1.32 trillion dollars in 2013 and since then smoothly reduced by 15%.

It is worth noting that China’s share in the total volume of issued US bonds was reduced even faster due to the accelerated increase in US public debt to finance various government-stimulating programs. The second largest economy in the world owns about 7% of 16.18 trillion dollars of outstanding debt, which is the minimum value for 14 years, although back in 2011 China owned 14% of the total US debt.

At the same time, the Fed during the QE programs accumulated almost 14% of the total market supply on the balance sheet.

The growth rate of supply is expected to continue to rise to cover the costs associated with tax reform, eroding China’s share and at the same time reducing China’s potential for manipulating its bond portfolio as a source of concern for other market participants.

China, as well as Japan are net exporters to the rest of the world thus, they should accumulate foreign reserves, respectively. The volume of reserves in China is approximately 3 trillion dollars, part of which is parked in the “risk-free” bonds of the US Treasury. In addition, after the crisis of 2007, the yield of US bonds outpaced the yield of bonds of other developed economies, such as Japan and Germany, which also supported China’s interest in the US dollar.

It is also important for China to keep a portfolio of US T-bills in order to manage the rate of the mainland yuan, both through the US debt market (through the impact on rates) and by selling bonds in order to increase the dollar supply in the domestic market. In 2016, the T-bills portfolio shrank by $200 billion from May to November, as the Chinese currency depreciated against the dollar and the need arose to stabilize the exchange rate by increasing the dollar supply. Thus, strong trade ties do not allow China to easily get rid of US bonds, since it is not only a tool for maintaining profitable trading conditions, but also maintaining a stable US economy which is the main consumer of China’s goods.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold