Main market themes

- China’s economy stabilised in Q4, according to GDP figures released overnight. YOY growth was steady at 6.0%, following deceleration in the prior two quarters. Full‑year growth for 2019 was 6.1%, within the government’s target range of 6.0-6.5%. The December figures for Chinese industrial production, retail sales and fixed asset investment beat expectations. That supported risk sentiment in the Asian market session.

- US stocks rallied, driven by upbeat retail sales data that matched economists’ estimate alongside stronger than expected Morgan Stanley earnings, just one day after the United States and China signed the Phase One trade deal.

- Gains were broad based and were led by the tech sector that prompted the S&P500 index (+0.8%) to breach 3,300 for the first time. The Dow Jones Industrial Average (+0.9%) and NASDAQ (+1.1%) also jumped to new highs.

- US bonds yields picked up by 1-3bps. Gold prices retreated to $1552.51/troy ounce, crude oils gained around 1% on trade optimism; Brent crude settled at $64.62/barrel.

- Upbeat US retail sales supported by strong consumer spending: US retail sector got a boost during the recent holiday season as the headline retail sales matched consensus forecast to print a 0.3% MOM growth in December (Nov: +0.3% revised) while sales for November was also revised higher to a 0.3% growth. Gains in December came from faster and higher sales of clothing, electronics and sporting goods as well as gasoline (thanks to higher gasoline prices). Sales of motor vehicles slipped after rising for two months. The socalled retail sales for control group, a gauge of core retail sales that exclude certain volatile items surpassed estimate by recording an impressive 0.5% MOM growth (Nov: -0.1% revised), adding to signs that consumer spending remains solid in the US thanks to a strong labour market. This was confirmed by the 10k decline in initial jobless claims to 204k, its lowest in six weeks for the week ended 11 Jan (previous: 214k). Adding to the positive number was the near 15pts jump in the Philly Fed Manufacturing Index (17.0 vs 2.4) that points to a strong recovery in Philadelphia’s manufacturing conditions at the start of the year.

- UK housing demand returned in late 2019 after election: The Royal Institute of Chartered Surveyor reported that its house price balance index rose by 10ppt to -2.2% in December (Nov: -11% revised), its best reading in three months. The smaller downturn was driven by a jump in both prices (+22pts) and sales expectation (+18pts) as well as new buyer enquiries (+22pts). The number of agreed sales and new instruction also went from previously negative readings to positive territories, offering tentative signs that buyers are returning to markets following the early December general election that lifted much of the Brexit uncertainties.

- Australia housing market on track to recover as home loans value climbed : Australia total home loan approval value continued to climb by 1.8% MOM in November (Oct: +2.1% revised), beating consensus forecast of 1.4% MOM, reaffirming that the housing market is on track for recovery in the short to medium term. Home loans value had been contracting throughout 2018 all the way to early 2019 before starting to record gradual increases, in tandem with the relaxation of policy by the Australian Prudential Regulation Authority (APRA) as well as the RBA’s series of rate cut in 2019 which resulted in lower borrowing cost. November print was supported by stronger lending to investors (+2.2% vs +1.5%) as growth in lending to owner occupier eased in November (+1.6% vs +2.3%).

- US data releases include industrial production and housing figures for December. Returning GM workers had led to a strong rise in November industrial output of 1.1%MOM. Market watchers expect a slight reversal in December of -0.1%MOM. The underlying picture for the sector remains soft, weighed by the impact of US-China trade disputes, although the ‘phase one’ trade deal signed earlier this week should reduce the risk of a re-escalation of tensions.

- US consumer sentiment, meanwhile, is expected to be broadly steady in January after reaching 99.3 in December, which is well above the long-term average. Consumer sentiment has been trending higher since August, which should underpin consumer spending.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1000 (EUR1.0bn); 1.1060 (EUR1.1bn); 1.1100 (EUR1.6bn); 1.1120 (EUR776mn); 1.1125 (EUR1.3bn); 1.1145 (EUR441mn); 1.1150 (EUR1.9bn); 1.1200 (EUR3.4bn)

- GBPUSD: 1.2975 (GBP460mn); 1.3075 (GBP393mn); 1.3095 (GBP268mn); 1.3110 (GBP212mn); 1.3130 (GBP369mn); 1.3150 (GBP221mn); 1.3185 (GBP387mn); 1.3200 (GBP286mn); 1.3300 (GBP1.0bn)

- USDJPY: 109.00 (USD465mn); 109.25 (USD1.1bn); 109.30 (USD413mn); 109.50 (USD554mn); 110.00 (USD990mn); 110.15 (USD510mn); 111.00 (USD815mn)

- AUDUSD: 0.6810 (AUD802mn); 0.6855 (AUD649mn); 0.6900 (AUD312mn); 0.6925 (AUD1.3bn); 0.6970 (AUD690mn)

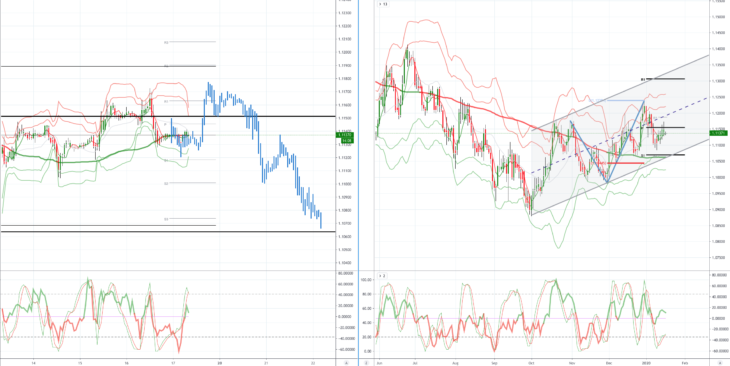

EURUSD (Intraday bias: Bearish below 1.1150 Bullish above)

From a technical and trading perspective, trapped between pivotal 1.11 and 1.1150, as 1.1150 caps (1.1164 symmetry swing resistance) corrections sellers will target a sustained breach of 1.11 en-route to a symmetry swing objective sited at 1.1040. If we can get a close above 1.1150 that would suggest a base at symmetry swing support and open a retest of cycle highs at 1.1239.

Note there are several large strikes for today’s New York cut; EUR3.3bn at 1.1200; EUR1.7bn at 1.1150; EUR1.22bn at 1.1125; EUR1.6bn at 1.1100, which will likely keep prices penned in for now.

GBPUSD (Intraday bias: Bearish below 1.31 Bullish above)

From a technical and trading perspective, another failure below 1.3150 opened anticipated test of bids below 1.3000, as 1.3060 caps corrections to the upside look for a test of bids and stops below 1.2950. A close above 1.31 would suggest a delay to downside objectives opening a retest of range resistance, with offers and stops above 1.32 targeted.

USDJPY (intraday bias: Bullish above 108.65 targeting 110.50)

From a technical and trading perspective, the breach of 109.50 provides a window for upside extension to challenge the 110.50 equidistant swing objective.Only a failure back below 109.40 would suggest another upside false break and return to well trodden range. Note significant sentiment divergence developing which will likely be addressed in the with consolidation/correction in the near term.

AUDUSD (Intraday bias:Bullish above .6880 Bearish below .6870 below)

From a technical and trading perspective, anticipated test of .6840 plays out as does profit taking here as we test symmetry swing support. There is a window for prices to base here and develop a platform for a correction to retest .6940 from below, a closing breach of this level will encourage bullish sentiment. A failure to establish ground above .6940 will likely see newly minted longs throw in the towel opening another test of .6840 bids.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold