Main market themes

- Daily market outlook – Global stocks slipped on Thursday amidst heightening US-China political uncertainty that dwarfed the recent optimism surrounding a potential mini trade deal.

- President Trump signed the controversial Hong Kong Humans Rights and Democracy Act that would require the US to annually assess Hong Kong’s autonomous status and ticked off Beijing which strongly upholds the “onecountry, two systems” policy unique in the post British colonial China-Hong Kong relation.

- US markets were closed for Thanksgiving holiday. Taking cue from the slide in Asian main markets from the Shanghai Composite Index to Hang Seng and NIKKEI 225, the key pan-European benchmark STOXX Europe 600 slipped0.2% while other key European indexes namely German DAX, France CAC 40 and UK FTSE 100 all ended in the red.

- Gold recovered modestly and JPY edged up a little. USD weakened in general amidst lighter trading.

- Brent crude lost 0.3% to $63.87/barrel.

- US stocks are set to re-open on Friday and futures point to lower openings, but volumes are likely to be thin. Asian equity markets were on the back foot overnight, led by Hong Kong and Seoul.

- Japan reported very weak October industrial production figures, falling 4.2%MOM, attributed to the sales tax rise, the typhoon and weak external demand. A couple of UK surveys for November were released overnight. The Lloyds Business Barometer showed a rise in overall confidence to 9% from 6%, a four-month high driven by a sharp improvement in optimism for the wider economy, while business prospects remained broadly steady. GfK consumer confidence was unchanged at this year’s low of ‑14. Earlier this morning, Germany reported surprisingly weak October retail sales which were down 1.9%m/m.

- Improvement in Eurozone sentiment: Eurozone sentiment picked up in November as the European Commission headline Economic Sentiment Indicator (ESI) rose to 101.3 (Oct: 100.8), beating expectations of 101.0. The positive print reflected slight to modest increases in confidence among consumers (+0.4pts to -7.2), retail trade managers (+0.7pts), industry (+0.3pts) and services (+0.3).

- According to Citi Bank month end relative outperformance of equities compared to bonds suggests a rotation from equities to fixed income with a moderately strong signal of +/- 0.6 historic std.dev US and Japanese equities are likely to note outflows while LatAm and Canadian bonds receive the strongest inflow signals. Interestingly, UK and LatAm are set to receive inflows into both equities and bonds. The asset rebalancing flow is likely to be stronger than the hedge rebalancing one and points to USD selling against EUR and GBP at month end

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0980 (EUR280mn); 1.0985 (EUR349mn); 1.1000 (EUR738mn); 1.1025 (EUR459mn); 1.1030 (EUR180mn); 1.1035 (EUR429mn); 1.1050 (EUR152mn); 1.1055 (EUR651mn); 1.1060 (EUR275mn); 1.1065 (EUR202mn); 1.1070 (EUR1bn); 1.1100 (EUR2.2bn)

- USDJPY: 108.50 (USD511mn); 108.65 (USD167mn); 108.90 (USD200mn); 109.00 (USD260mn); 109.09 (USD140mn); 109.30 (USD100mn); 109.35 (USD540mn)

- GBPUSD: 1.2850 (GBP181mn); 1.2880 (GBP120mn); 1.2900 (GBP385mn); 1.2940 (GBP161mn); 1.2950 (GBP849mn)

- AUDUSD: 0.6786 (AUD200mn); 0.6800 (AUD239mn)

EURUSD (Intraday bias: Bearish below 1.1070 targeting 1.0960)

From a technical and trading perspective, the failure to hold 1.1030 combined with Thursday & Fridays bearish reversals suggests tactical USD bullish bias into this week. I retain short exposure from Friday, look for 1.1050 to cap upside attempts targeting a test of bids sub 1.1000. On the day only a close above 1.1070 would suggest downside failure and a return to range. EURUSD volatility made new lows on the year yesterday as trading range contract significantly. Grinding to a holt, shorts are starting to look vulnerable, as 1.10 area continues to support month end flow may support a squeeze higher today.

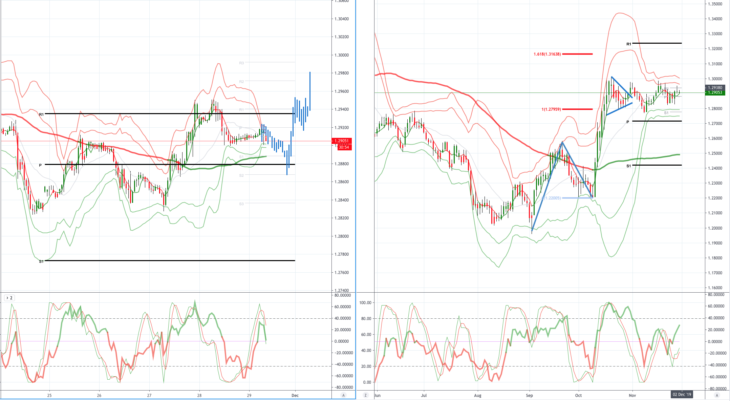

GBPUSD (Intraday bias: Bullish above 1.29 targeting 1.32)

From a technical and trading perspective, 1.29 is the bull bear line in the sand this week, a drive through offers and stops here will set up a grind higher to retest offers and stops above 1.30 en route to the broader upside objective of 1.32, on the week only a failure below 1.2820 would open a test of support towards 1.2720 with further consolidation in the 1.27/1.29 range.

GBPUSD…UPDATE close above 1.29 injects upside momentum, with stops above 1.30 the immediate upside objective, only a reversal below 1.2820 would concern the bullish bias suggesting a false upside break and return to well defined 1.27/1.29 range

USDJPY (intraday bias: Bullish above 109 targeting 110.50)

From a technical and trading perspective, the anticipated further long liquidation to test bids back towards 108.50 played out and bulls once again defended the key support, a failure to recapture ground above 109 suggests another test of bids towards 108.50. A close above 109.50 opens 110.50 test.

USDJPY…UPDATE the upside breach of 109.50 on a closing basis suggests a further grind higher to test the long awaited 110.50. Caution in lower liquidity today as a close back below 109 would suggest a false break and return to range 108/109

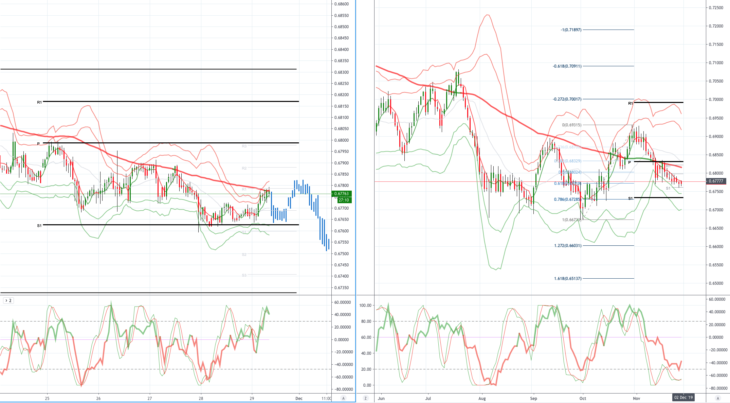

AUDUSD (Intraday bias: Bearish below .6830 targeting .6750)

From a technical and trading perspective, pivotal .6830 prior support now acts as resistance only a sustained drive through this level would suggest a false donside break and confirm a base for another assault on .6900 offers and stops. As .6830 caps upside attempts expect a retest of Fridays low enroute to a test of .6765 NO CHANGE IN VIEW

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold