- Dollar ends lower, stocks soar as Fed can’t convince markets it will hit ‘pause’

- Loonie hammered as BoC drops neutral stance, hints at ‘insurance cut’

- BoJ strengthens easing bias, but yen yawns

- Eurozone, US, and Canadian data coming up today

Fed cuts rates and signals a pause, but markets don’t buy it

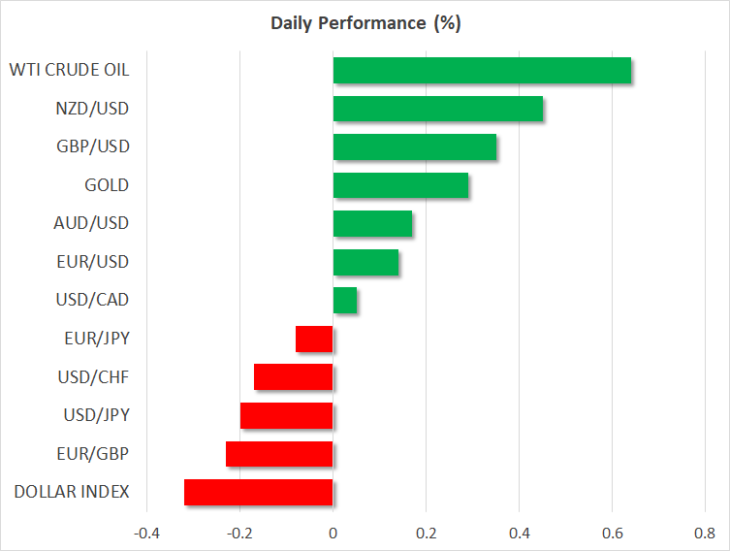

The Fed cut rates yesterday by another quarter-point, as widely expected, but refrained from signaling that any more cuts are coming. The phrase “will act as appropriate to sustain the expansion” was removed from the statement, hinting that policymakers may hit the pause button for a while and allow the already-enacted stimulus some time to work, having cut rates three times now. That sent the dollar higher alongside US bond yields, as investors pared back bets for more easing.

It wasn’t meant to last though, with the dollar giving up all its gains to trade lower overall after Chairman Powell stepped up to the rostrum. Even though he started by confirming the Fed may pause, saying that it would take a “material” shock for rates to be cut again for example, the markets oddly focused on a much different remark. Namely, that “a really significant move up in inflation” is needed before the Fed even considers raising rates.

The takeaway for investors was that while the Fed wants to pause, it will still cut rates if anything adverse happens, whereas it won’t raise them even if the economy picks up steam – which was enough to propel the likes of the S&P 500 to new record highs.

Where does all this leave the dollar? Admittedly, it’s still difficult to throw in the towel on the world’s reserve currency. For all its troubles, the American economy is still far stronger than Europe, which is mired in structural and institutional issues. Unless the Fed gets ‘ahead of the curve’ and starts slashing rates much more aggressively or Germany rolls out a substantial fiscal stimulus package, it’s very hard to envision sustained weakness in the greenback.

Bank of Canada pulls out a dovish surprise

Across the border, the BoC took many traders by surprise as well, striking a dovish tone at its own meeting yesterday even despite a solid domestic economy. Policymakers emphasized the downside risks emanating from trade conflicts, indicating that “the resilience of Canada’s economy will be increasingly tested” going forward.

The signal was that rate cuts are back on the menu, with Governor Poloz taking a page out of Powell’s book and indicating that they even debated an “insurance” cut, but decided against it for now. The loonie got hammered as investors priced in a much greater likelihood for BoC rate cuts, derailing the narrative that Canada will be an oasis of neutrality in a desert of global monetary easing. Markets are currently factoring in a mere 27% probability for a cut in December, which seems insufficient considering that the bar for an insurance cut may be pretty low.

BoJ stands pat, but reinforces easing bias

Overnight, the Bank of Japan (BoJ) refrained from adding to its already-massive stimulus program but recalibrated its forward guidance to indicate that rates will remain at current or lower levels for longer. This opens the door for some more stimulus down the road. Yet, the yen barely reacted, likely because the BoJ’s policy arsenal is nearly exhausted already. The safe-haven currency will continue to be driven by ‘risk’ flows.

Busy day ahead: Eurozone, US, and Canadian data

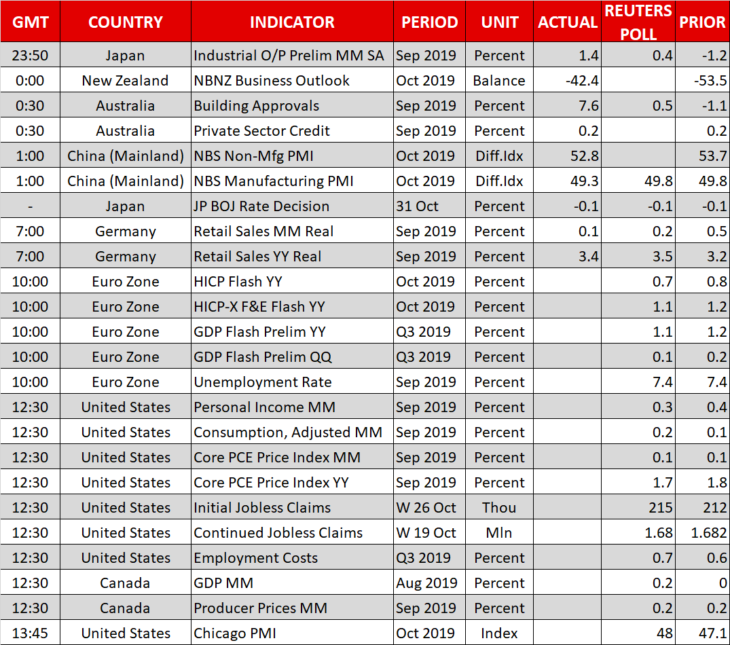

With central banks out of the way, the focus now turns to economic data. In euro land, preliminary GDP for Q3 will shed some light on how much damage the manufacturing malaise has inflicted on economic growth.

In the US, personal income and spending data for September, together with the core PCE price index, will serve as an appetizer before tomorrow’s all-important payrolls report.

Canada’s GDP numbers for August are also due.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold