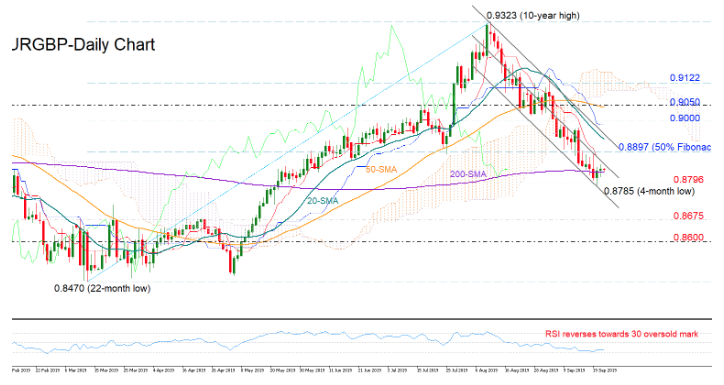

EURGBP collected more losses after closing below the 50% Fibonacci of the upleg from 0.8470 to 0.9323, with the price hitting a four-month low of 0.8745 on Friday.

The pair has been putting effort to change direction this week within the lower part of the descending channel, but the technical indicators provide little hope for a meaningful rally as the RSI seems to be reversing towards its 30 oversold mark again, while the red Tenkan-sen is flattening well below the blue Kijun-sen line.

Traders will likely wait for the market to correct clearly above the 50% Fibonacci of 0.8897 to increase buying orders. Should that happen, the price could run until the upper boundary of the channel currently seen around 0.8950 and the 20-day simple moving average (SMA). Should the bulls break that obstacle and pierce the 0.9000 mark too, resistance could next be found around 0.9050 and ahead of the 23.6% Fibonacci of 0.9122.

Alternatively, a drop under the 200-day SMA and the 61.8% Fibonacci of 0.8796 could move support to the bottom of the channel seen around 0.8750. Any violation at this point could strengthen negative momentum towards the 0.8675-0.8600 area.

In the three-month window, the market turned slightly bearish following the decline under the 50% Fibonacci, with the weakening 50-day SMA endorsing the softer outlook.

Summarizing, EURGBP is expected to print a bearish-to-neutral session in the short-term, while in the medium-term the risk looks to be shifting to the downside.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold