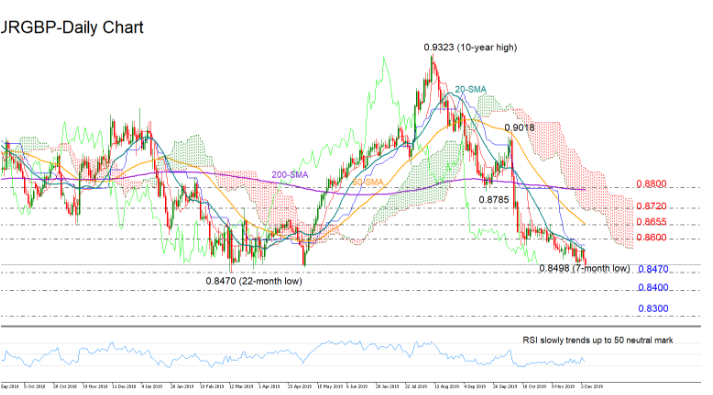

EURGBP started the month on the downside as buyers could not close above the 20-day simple moving average (SMA) that has been restricting upside corrections over the past four weeks.

The short-term bias is currently viewed as bearish-to-neutral as the RSI looks to be distancing itself from its 30 oversold mark to reach its 50 neutral mark, while in Ichimoku indicators, the red Tenkan-sen line is stabilizing slightly below the blue Kijun-sen.

On the downside there is a strong support between 0.8498 and 0.8470. Should the price fail to rebound within this area, the door would open for the 0.8400 round level, a break of which could then shift attention towards the 0.8300 mark.

In the positive scenario, a decisive close above the 20-day SMA and preferably above the 0.8600 barrier could bring a stronger obstacle near 0.8655 back into view. Moving higher and above the 50-day SMA, the bullish action could pick up steam towards 0.8720, where any violation would push resistance up to 0.8800.

Turning to the medium-term picture, the fourth-month old downtrend off the 10-year high of 0.9323 continues to keep the outlook negative, with the latest bearish cross between the 50- and the 200-day SMAs reducing the odds for an outlook reversal.

In brief, EURGBP is expected to trade bearish-to-neutral in the short-term, with traders likely waiting for a clear close above the 20-day SMA in order to place buying orders.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold