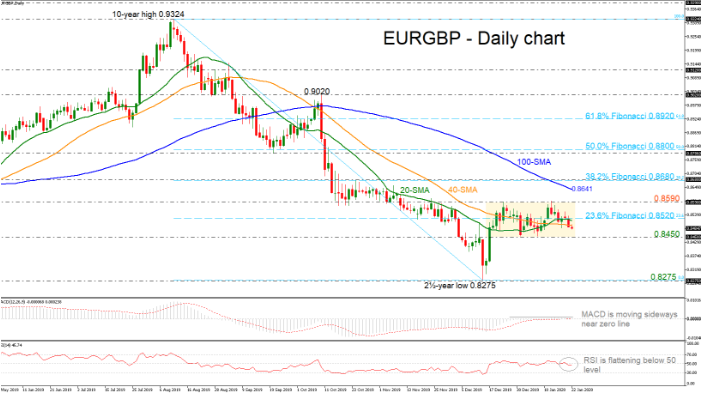

EURGBP is consolidating within a tight trading range over the last month with an upper boundary at the 0.8590 resistance and the lower boundary at the 0.8450 support level. Currently, the pair is capped by the short-term moving averages and the 23.6% Fibonacci retracement level of the downward wave from 0.9324 to 0.8275 near 0.8520, suggesting a potential breakdown of the channel.

The technical indicators are flattening, confirming the recent view in the daily timeframe. The MACD is moving with very weak momentum slightly above the zero level, while the RSI is lacking direction below the 50 level.

The immediate support level is coming from the 0.8450 barrier and any violation of this barrier could open the way for the two-and-a-half-year low of the 0.8275 crucial support, registered on December 13.

In the alternative scenario, an upside run above the 20- and 40-simple moving averages (SMAs) and the 23.6% Fibo (0.8520) could drive the price to flirt with the 0.8590 significant resistance. Even higher, EURGBP could see a pause near the 100-SMA, which stands at 0.8641 and the 38.2% Fibonacci of 0.8680.

In brief, although, the pair has been in a bearish mode over the past six months, it is heading sideways in the short-term.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold