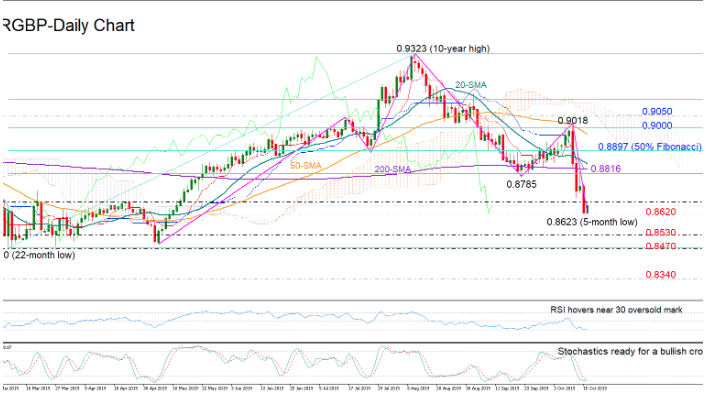

EURGBP’s rebound off 0.8785 proved fragile as sellers took full control below 0.9000, violently pushing the price towards a five-month low of 0.8623 early on Wednesday.

Technically, the market looks to have entered oversold territory as the RSI is close to 30 and the fast-Stochastics are searching for a bullish cross under 20. However, both indicators need to show a clear upside reversal to confirm that selling pressure has hit limits.

Interestingly, a lower high at 0.9018 has followed the creation of a lower low at 0.8785, scrapping the uptrend started in May and signaling that a downward pattern may be in progress.

A rally above 0.9050 is probably what traders would like to see to resume buying interest. Before that however, the price needs to overcome the 200-day simple moving average (SMA) currently at 0.8816, the 50% Fibonacci of the upleg from 0.8470 to 0.9323 at 0.8897, and then the 0.9000 round level.

Should the bears drive the price below 0.8620, the way could open towards the 0.8530-0.8470 support area, where any breakout could bottom somewhere near the 0.8340 former barrier.

Meanwhile in the medium-term window, the neutral outlook switched to bearish after the close below 0.8785, with the weakening SMAs endorsing the negative change in the sentiment.

Summarizing, bears are expected to keep driving EURGBP lower, though they look to be running out of fuel, signaling that negative momentum is close to stalling. The downside trend, however, could remain in place, reinforcing the discouraging outlook in the medium-term picture.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold