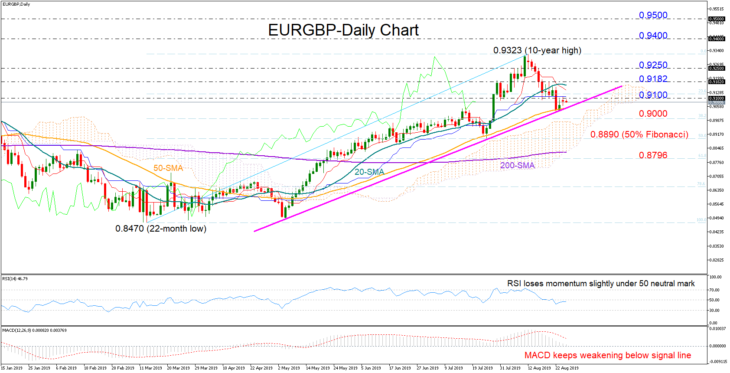

EURGBP remained below the 0.9100 level despite bouncing on the critical 3-month old ascending trend-line last week. With the RSI losing steam slightly under its 50 neutral mark and the MACD weakening below its red signal line, the short-term session is expected to appear neutral-to-bearish.

The upward-sloping trend-line could play a key role for the market to keep the upside direction. However if the bears manage to push the wall down, the 38.2% Fibonacci of 0.9000 of the upleg from 0.8470 to 0.9323 could take control before the spotlight turns to the 50% Fibonacci of 0.8890. Beneath the latter, the area between the 200-day simple moving average (SMA) and the 61.8% Fibonacci of 0.8796 could be another important obstacle.

Should the price resume positive momentum above the 0.9100 handle, resistance could run up to 0.9182, where the bullish action stalled earlier this month. Higher, the 0.9250 barrier could halt upside movements ahead of the 10-year high of 0.9323, while a steeper rally at this point could also reach the 0.9400-0.9500 region which strongly rejected the bulls during 2009.

In the medium-term picture, EURGBP is still in the green zone and is likely to maintain the bullish profile as long as it keeps trading above the 0.9000 level.

In brief, EURGBP is likely to face a neutral-to-bearish session in the short-term and hold positive in the medium-term.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold