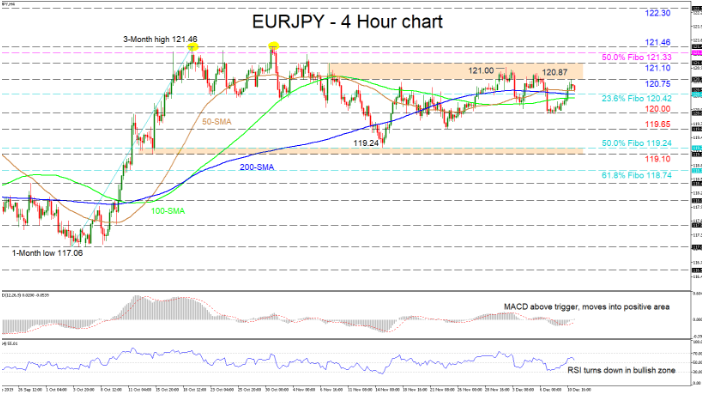

EURJPY is trading around the 120.42 level, which is the 23.6% Fibonacci retracement of the up leg from 117.06 to 121.46 and where the 200-period simple moving average (SMA) is presently located. Although the price is above all the SMAs, it is displaying an uncertain picture, with the stall in the market also reflected in the flattened SMAs and the conflicting signals in the short-term oscillators.

The technical indicators are exhibiting contradictory signals in directional momentum. The MACD is above its red trigger line and has just moved into the positive zone, while the RSI has turned downwards in the bullish region.

If sellers steer below the area of the SMAs and the 23.6% Fibo of 120.42, the low at the 120.00 handle could be next to apply upside pressure followed by the support at 119.65. Surpassing this, a key region of 119.24 to 119.10 – consisting of the 50.0% Fibo and swing low from October 15 – could challenge the bears. Overtaking this too, the 61.8% Fibo of 118.74 may halt further declines.

If buyers resurface and push higher, initial resistance could come from the 120.75 to 121.10 area involving multiple highs. Overcoming this restricting area, the 121.33 level – which is the 50.0% Fibonacci retracement of the down wave from 126.80 to 115.85 – and neighboring peaks of 121.46 from October could test attempts to reach the 122.30 high from July 10.

Overall, a neutral bias continues to exist in the short-term and a break either above 121.10 or below 119.10 would reveal the next direction.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold