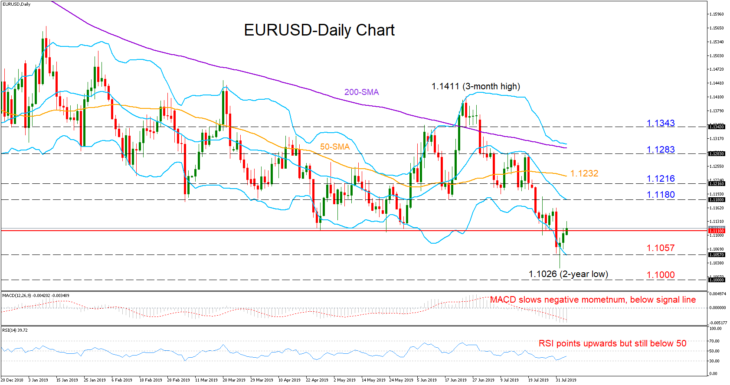

EURUSD switched to recovery mode after the free-fall towards a more-than-two-year low of 1.1026 last week. But the bearish forces have not faded yet as the RSI continues to move below 50 and the MACD under its red signal line despite showing some improvement.

A closing price above 1.1180 and the 20-day simple moving average (SMA) could bring additional buying interest, with resistance running next up to the 1.1216-1.1232 area where the 50-day SMA (middle Bollinger band) is currently laying. Slightly higher, the 1.1283 number and the 200-day SMA could also keep the bulls busy before a stronger wall appears near 1.1343.

In case the pair returns below 1.1100, the lower Bollinger band at 1.1057 could halt downside movements, while a deeper decline may also stall within the 1.1000-1.0950 region.

In the medium-term (three-month picture), the market is ready to return to neutrality as the price is testing the lower boundary of its 1.1100-1.1411 range zone. Yet with the 50- and the 200-day SMAs pointing downwards, the odds for a brighter outlook are currently viewed to be minimal.

Summarizing, EURUSD continues to face downside risks in the short-term, while in the medium-term, the pair is looking bearish-to-neutral.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold