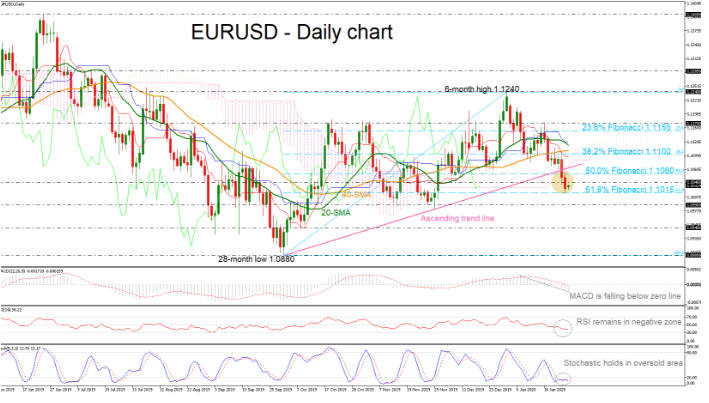

EURUSD has been underperforming in the past two days, breaking the almost four-month old ascending trend line to the downside. The price reached an eight-week low around 1.1019, distancing itself from the Ichimoku cloud and the short-term moving averages in the daily timeframe.

Momentum indicators are pointing to a negative bias in the short term as the RSI is hovering above its 30 oversold mark but below 50 and the stochastic oscillator is flattening in the bearish territory, both confirming the recent downward movement in the price. Also, the MACD is strengthening its momentum to the downside below the trigger and zero lines.

Further losses should see the 61.8% Fibonacci retracement level of the upleg from 1.0880 to 1.1240 near 1.1015. A significant drop below this area could open the door for the 1.0990 support, taken from the lows on November 27, while lower the price could hit the 1.0940 region, shifting the medium-term outlook from neutral to bearish.

In the event of an upside reversal, the 1.1040 resistance and the 50.0% Fibo near 1.1060 could attract buyers’ attention. A break above the latter could challenge of the 38.2% Fibo of 1.1100 and the 40- and 20-SMAs currently at 1.1110 and 1.1120 respectively.

Overall, EURUSD seems ready for a downside run following the penetration of the rising trend line.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold