Previous:

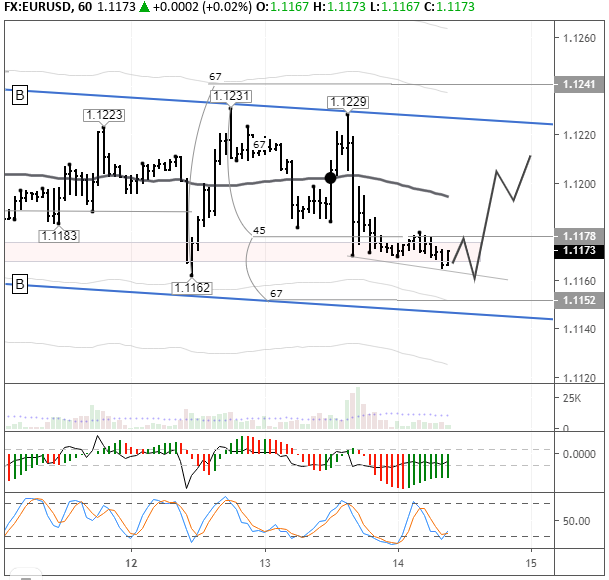

On Tuesday the 13th of August, trading on the EURUSD pair closed down. Volatility was high during the European and US sessions. Trading in the US saw the euro drop to 1.1170. This came after reports that Washington is planning to delay the introduction of new tariffs on Chinese goods (specifically mobile phones and computers) until the 15th of December. The announcement came from US Trade Representative Robert Lighthizer.

The dollar also made gains following the publication of a strong consumer inflation report, which exceeded market expectations. The pickup in inflation could provide justification for the Federal Reserve to maintain interest rates at their current level through the end of the year. US CPI in July rose by 0.3% on June’s value, and by 1.8% in annual terms. This was against a MoM forecast of 0.3% and 1.7% YoY.

Day’s news (GMT+3):

- 11:30 UK: CPI (Jul), retail price index (Jul), PPI (Jul).

- 12:00 Eurozone: GDP (Q2), employment change (Q2), industrial production (Jun).

- 17:30 US: EIA crude oil stocks change (9 Aug).

Current situation:

The pair recovered to the upper boundary of the channel as expected. The sharp reversal came as a surprise, but it’s likely that no one was prepared for such news on tariffs from the US. Today, we expect the euro to rise to 1.1211. If the recovery has legs, it should continue to 1.1220.

Why growth, and not decline?

- The yuan slipped after weak Chinese data (retail sales and industrial production).

- Tension remains over the situation in Hong Kong.

- The stochastic is in the buy zone.

- The EURUSD pair is still trading within the channel.

We could see a fresh low before the pair starts rising if German and Eurozone GDP data disappoint. We’re also expecting Eurozone data on industrial production and employment. UK CPI will come out a bit earlier. So, today, we’re expecting to see the pair move against the decline saw in yesterday’s US session. This scenario will not play out if the hourly candlestick closes below 1.1155.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold