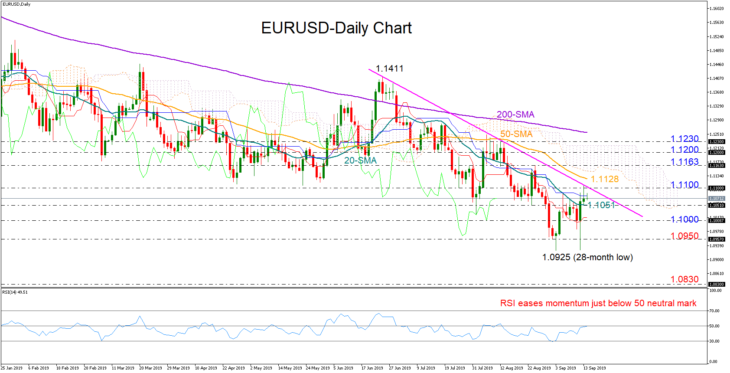

EURUSD managed to quickly recover from 28-month lows last week but once again the bulls did not have the strength to close above the down-trending line drawn from the 1.1411 peak.

The short-term bias is now looking neutral-to-bearish as the RSI eases momentum marginally below its 50 neutral mark and the red Tenkan-sen is stabilizing well under the blue Kijun-sen line.

For a meaningful rally, buyers need to snap the descending trend-line seen around 1.1100 and particularly close above the 50-day simple moving average (SMA) currently near 1.1128. An extension above the previous high of 1.1163 could cement the latest rebound and stretch it towards the 1.1200-1.1230 resistance zone.

On the other hand, another rejection from the descending line and a pullback below the 20-day SMA could initially see a retest of the 1.1000 -1.0950 area and then a review of the 28-month low of 1.0925. Beneath the latter, the sell-off could pause near the 1.0830 former support level before a stronger barrier potentially appears around 1.0700.

In the medium-term picture, the market continues to print lower highs and lower lows, with the falling 50-day SMA reducing the odds for an outlook reversal.

Summarizing, EURUSD is expected to register a neutral-to-bearish print in the short-term unless the price breaks above 1.1128. In the medium-term, the downward pattern is likely to stay in play.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold