The British Pound has been moving downwards against the USD for quite a long time and nothing is changing early in another January week.

The Pound is pretty nervous in anticipation of the final stage of the Brexit – the country is set to exit the European Union in less than three weeks. Even though all key aspects were already agreed on and only nuances are left, market players don’t look relaxed. It goes without saying that there is always a chance of force majeure.

Last Friday one of the Bank of England representatives said that the way the British economy responded to the Brexit would be decisive for developing the regulator’s monetary policy in the future. At the same time, he didn’t exclude a possibility of further stimulus in the coming months, apparently in the form of the interest rate cut.

There will be quite a lot of numbers from the United Kingdom today and there is a chance that investors will finally pay some attention to them. For example, the Industrial Production and the Manufacturing Production in November, as well as the November GDP report (no changes are expected) and the NIESR GDP Estimate for December.

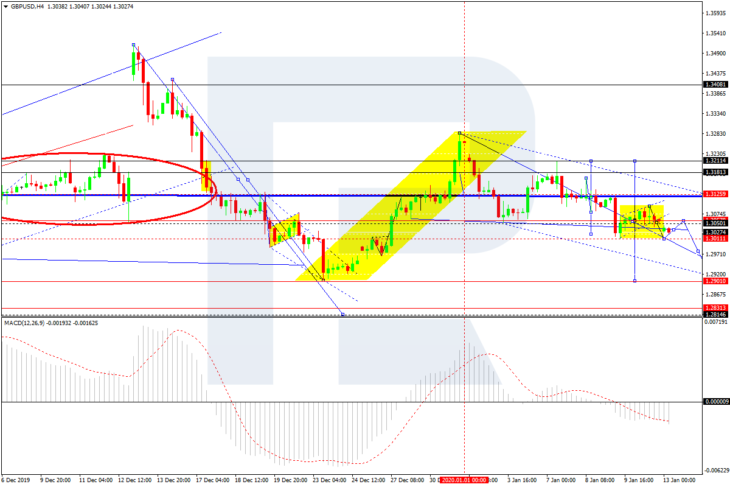

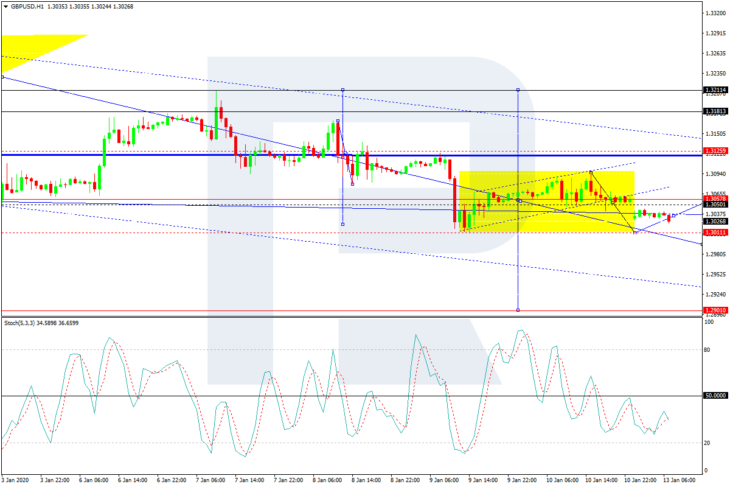

GBP/USD on charts

As we can see in the H4 chart, GBP/USD is moving downwards; it has broken 1.3050 and may continue falling with the short-term target at 1.2910. After correcting towards 1.3050, the pair may resume the downtrend to reach 1.2833. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving below 0, thus indicating a descending tendency.

In the H1 chart, GBP/USD is forming another descending wave towards 1.3000. After reaching it, the instrument may start a new correction to return to 1.3050 and then resume trading downwards. If the price breaks 1.3000, it may continue falling with the short-term target at 1.2910 to finish the third descending wave inside the fifth one. Later, the market may form one more correction to return to 1.3050. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is moving below 50, thus indicating a strong descending tendency.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold