The British pound on Tuesday experienced the sharpest decline in 13 months. The GBPUSD declined by 1.6% due to concerns over the hard line of Boris Johnson on trade negotiations with the EU. The impressive majority of the conservative party will break the legislative deadlock. However, this deadlock may occur again if the position of the party leader is too tough, which will not meet the support of other tories.

The markets may have run ahead of the train again, expecting the volatility of the pound to be over. In this case, there are more and more similarities with Trump, whose arrival marked the increased uncertainty for the markets, although it still contributed more to their growth than to their decline for stocks.

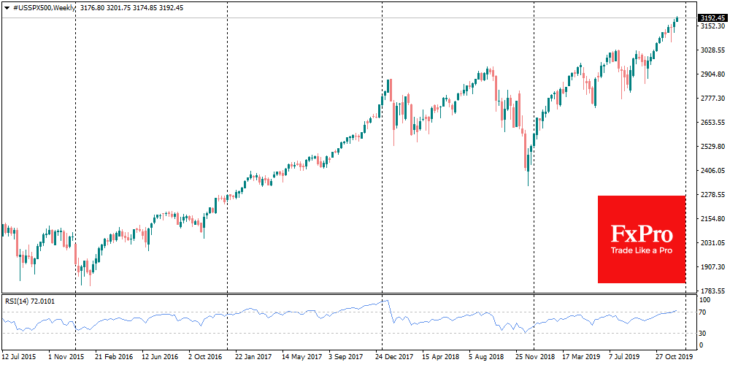

However, one should remember that currencies work a little differently. Uncertainty causes pressure on quotes, as it is associated with the weakening of economic data and implies a more cautious tone of monetary policy. By comparison, the S&P 500 has grown by more than 55% since Trump was elected, having experienced only one sharp correction at the end of last year. Over the same period, the dollar index initially declined, losing 15% despite higher Fed rates, but since 2018 it climbed by 10% on trade wars worries.

The same increased volatility and lack of a clear trend were characteristic of the pound after the 2016 referendum, and are likely to remain with it at least in 2020.

The most popular currency pair – EURUSD – is experiencing its mini-moment of truth. The Euro could not overcome the level of 1.1200, stalling near the resistance levels of the last two months, and staying at the important waterline in the form of the 200-day moving average. The fact that the bears quickly joined the game on the way to the critical level indicates a possible desire to stay within the downward trend in the coming days and weeks until new signals arrive.

Surprises, of course, are not ruled out until the end of the year, but expectations are growing that even the main market-mover Donald Trump may pause until the end of the year, helping the markets to postpone the vital battle for the trend to next year.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold