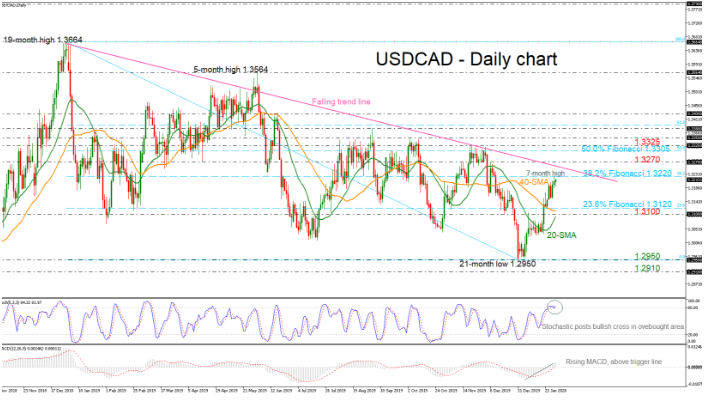

USDCAD is trading not too far from yesterday’s seven week high of 1.3220, which is the 38.2% Fibonacci retracement level of the down leg from 1.3664 to 1.2950. The bullish correction, which initially pivoted off the 21-month low of 1.2950, is approaching the one-year downtrend line.

The technical indicators are confirming the positive structure on price. The stochastic oscillator is posting a bullish crossover within the %K and %D lines in the overbought zone. The MACD is strengthening its upside momentum above its trigger and zero lines, giving signals for more gains.

A potential jump above the 38.2% Fibo could find nearby resistance at the descending trend line near 1.3255. A successful climb above this strong line would open the way for the 1.3270 resistance and the 50.0% Fibonacci of 1.3305, switching the long-term bearish view to neutral.

If the positive move fails to hold and price deflects off the trend line and reverses lower, the 23.6% Fiboof 1.3120 and the 1.3100 handle could come in focus. Within this area the 40-day simple moving average (SMA) is a strong support level before the price touches the 20-day SMA at 1.3093. More downside pressure could hit the 1.2950 support barrier.

All in all, in the very short-term, USDCAD has been in an upside tendency this month but the diagonal line may be a level to halt the gains.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold