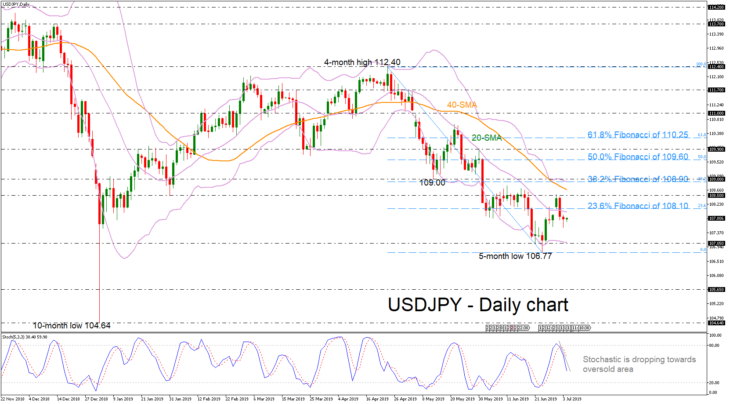

USDJPY held in losses over the previous couple of days, dropping back below the 23.6% Fibonacci retracement level of the downfall from 112.40 to 106.77 near 108.10 and the 20-day simple moving average (SMA). The negative bias in the near term is supported by the deterioration in the stochastic oscillator. The %K line of the stochastic is falling sharply towards oversold levels and posted a bearish crossover with the %D line.

If prices continue to head lower, support should come from the lower Bollinger band, which overlaps with the 107.05 barrier. A drop below this line would open the door for the five-month low of 106.77, while even lower the ten-month low of 104.64 comes into play, reinforcing the bearish bias.

However, should an upside reversal take form, immediate resistance will likely come from the 23.6% Fibonacci mark of 108.10, before touching the latest high of 108.50. A successful advance above this level would take the market until the 40-day SMA currently at 108.66 ahead of the strong resistance near the 109.00 handle, which encapsulates the upper Bollinger band and the 38.2% Fibo.

In the short-term, the outlook remains negative since prices hold below all the moving average lines after the decrease from the 112.40 hurdle.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold