The hawkish nature of the FOMC policy meeting late on Wednesday allowed USDJPY bulls to retake control and pick up steam above the 109 important level.

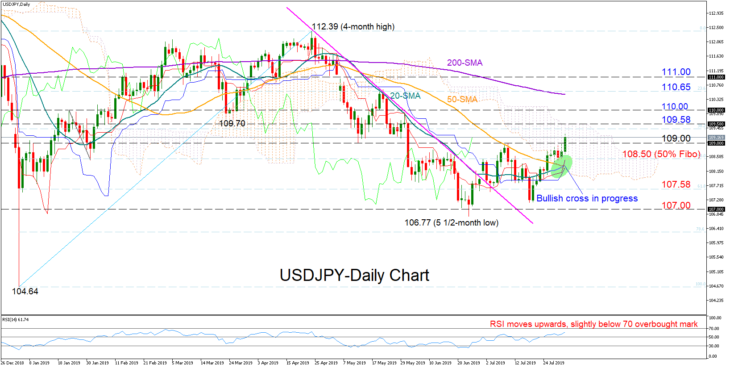

Technically, the pair could consolidate gains in the short-term as the RSI is positively sloped and not far below its 70 overbought mark; the indicator is already in the overbought territory in the four-hour chart. Yet, with the price having cleared the 50-day simple moving average (SMA), and the 50% Fibonacci of the upleg from 104.64 to 112.39, the market is likely to keep trending up. It is also worth mentioning that the 20-day SMA is set to cross above the 50-day SMA, increasing hopes for an upward-moving market.

On the way up, the price should climb above the upper surface of the Ichimoku cloud, currently around 109.58, for the rally to continue until the next 110 major resistance level. Higher, the bulls could hit a stronger wall near the 200-day SMA and the 23.6% Fibonacci of 110.56, which if finally broken, could open the door for the 111 psychological mark.

In case of a downside reversal, a closing price below 109 could initially retest the 50% Fibonacci of 108.50. Should the market weaken under the 20-day SMA and the cloud, the spotlight will turn again to the 61.8% Fibonacci and the 107 round-level.

Meanwhile in the three-month picture (medium-term), the lower highs and the lower lows from the 112.39 peak continue to hold sentiment bearish and only a decisive close above the 110 number could shift the outlook to neutral.

In brief, the short-term bias is currently viewed cautiously as bullish, while in the medium-term, a stronger upturn above 110 is required to shift the outlook from bearish to neutral.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold