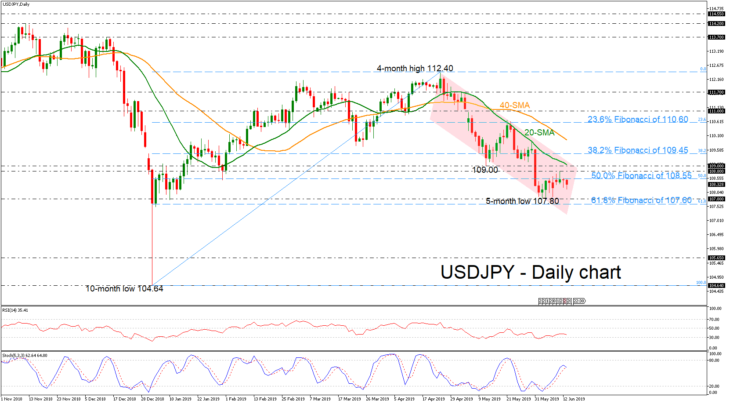

USDJPY has been on the sidelines for the most part of the week as the 109.00 level seems to be a real obstacle for the bulls. Over the last seven weeks the pair has been developing in a descending channel, erasing the bullish retracement from the 104.64 support.

Technically, the price could lose some ground in the short-term as the RSI is moving downwards in the negative area, while the stochastic is creating a bearish cross within the %K and %D lines.

A continuation of the rebound from the five-month low, could meet strong resistance between 108.80 and 109.00, where the 20-day simple moving average (SMA) is located. Exiting the channel, the 38.2% Fibonacci of the upleg from 104.64 to 112.40 near 109.45 could halt further advances.

Alternatively, a decline under five-month low (107.80) should keep the pair in a bearish mode, challenging the immediate support of the 61.8% Fibonacci region of 107.60. A strong rally below this line could open the way towards the 105.65 hurdle, identified by the low on January 2018.

In the short-term picture, USDJPY is gently pointing down after the bounce off the four-month high of 112.40. Only an upside run above the aforementioned obstacle could turn the bias back to bullish. Otherwise traders will most likely look for negative movements.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold