Market pricing is always based on a so-called “Demand and supply formula”, no matter what market you are on – commodity, financial, or raw materials one. In any trade, there is always a seller and a buyer. The seller aims at selling at a higher price, the buyers aim at buying at a lower price. When the interests of both sides coincide, the trade happens. How is the price formed?

How the price is formed on Forex

Pricing on a financial market is based on an open market auction. The price is born from the ratio of demand and supply at a certain moment. In reality, hundreds of thousands of operations are carried out simultaneously on a currency market, which results in 5 trillion USD passing through Forex every day.

If at a certain moment there are more sellers than buyers, the price drops. If there are more buyers than sellers, the price grows. All this leads to constant price fluctuations and changes.

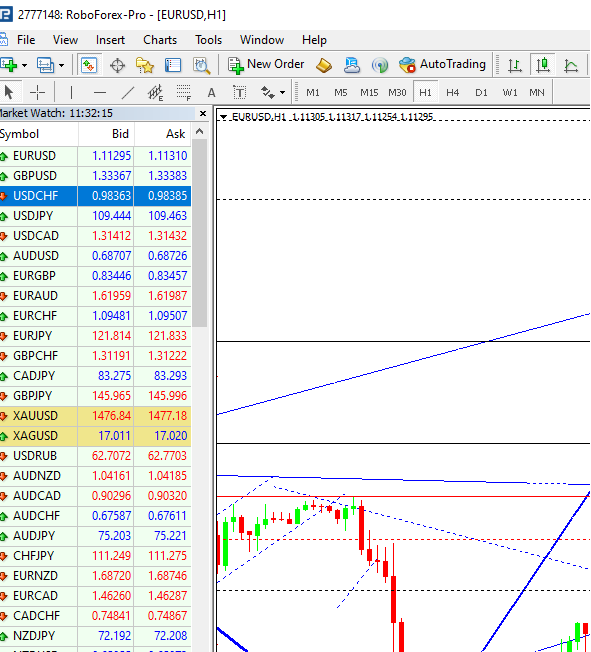

All price movements can be seen in the window “Market review” of the terminal.

Bid, Ask and spread on Forex

In the “Market Review”, there are the tickers of currency pairs displayed (Simbol). In front of each asset, there are the current Bid and Ask prices.

The Bid price is the best selling price, the Ask price is the best buying price.

As one example, let us look at the EURUSD pair:

The Bid is 1.1636, at this price we sell the instrument. The Ask is 1.1651, at this price we buy the instrument. The difference between them is 1.1651 – 1.1636 =0.0015. It is called a spread.

Swap

Swap is the difference in the interest rates of each currency of the traded instrument.

Let us imagine we have bought the euro (EUR) and sold the dollar (USD). The interest rate on the EUR is 2%, on the USD — 1%. If we move the open position to the next day, we will get additionally about 1% of the open position for using loaned money.

2% – 1% = 1%

Imagine we sell the EUR and buy the USD. Then, we will lose 1% for transferring the position:

1% – 2% = -1%

Swaps may be positive and negative. This happens because initially, we do not own the EUR, for the trade, we practically loan the capital we need. For its use, we pay the percent from our deposit. Conversely, we can receive the capital at the moment the trade is closed.

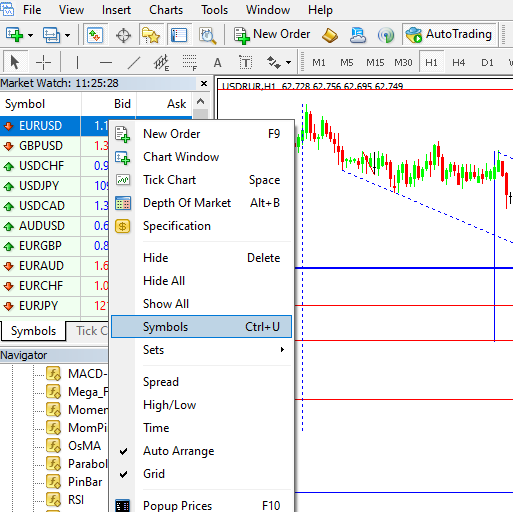

To know the size of the swap on an instrument, we right-click the necessary asset and choose “Simbol” in the unfolding menu.

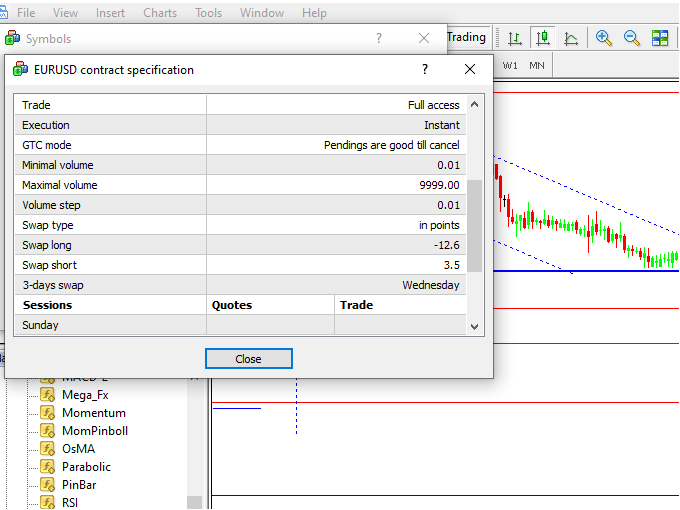

Then via “Properties”, we open “Contract Specification”.

Here, in the lower part of the table, we can see the current swaps at the moment of buying or selling the financial instrument. We also recommend paying attention at the last line to keep track of the triple swap connected to weekends. Triple swap is only relevant when a position is left on the market for the weekend. It is deposited on the specified day of the week at 00:00 of the terminal time (in our case — on Wednesday to Thursday night).

Closing thoughts

As we see, the notions of the price, Bid, Ask, spread, and swap are clear and easy to understand. Apart from them, important things in trading are historical data, the results of tech and fundamental analyses; using stop orders is also important. The thing is that the price also depends on:

- the political situation in the world

- the speeches of world leaders

- wars, terrorist acts, natural disasters

Successful trading to all of you!

Read more

https://fortraders.org/en/forex-education/for-beginners/trend-vs-flat-types-of-price-movements-on-forex.html

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold