A Forex stop loss is a function offered by brokers to limit losses in volatile markets moving in a contrary direction to the initial trade. It is an important elements of trade management and is just as important as the analysis one would do before opening a position.

The idea of good stop loss placing is to help you keep your losses small and avoid emotions taking control over your decisions. It is used by investors as it helps them to limit the losses and lock in the profits.

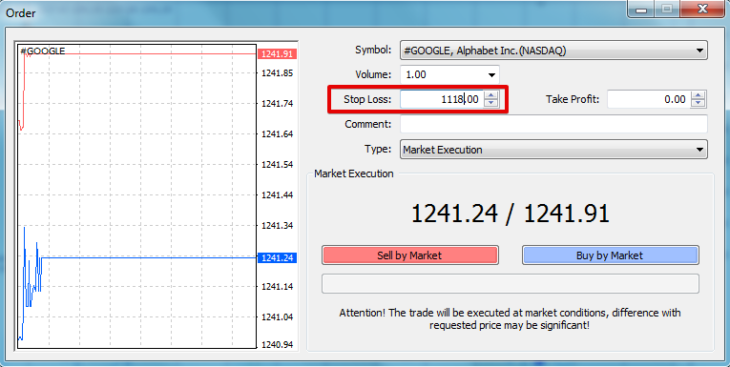

Stop Loss is an adjustable order to close the trade when the market moves a specified amount against your position and helps you minimize your losses in case the market moves in the opposite direction to what you expected.

For example

Imagine you bought an Google’s share for $1242 and it is comfortable for you to set up a 10% stop loss. It’s means that you do not want to lose more than 10% from your invested money ($1242) or 1242 * 10% = $124. So you need to sell your Google’s share at $1118 (=1240-124) if the share price starts to fall.

Stop Loss in MT4However, the set Stop Losses are not guaranteed. It’s just a trigger you let your broker know that you want to sell it on the given price. Brokers don’t sign a guarantee for the execution of the stop loss, but they do it on the best available price for you.

Read more

https://fortraders.org/en/forex-education/buy-and-sell-in-forex-market-orders.html

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold