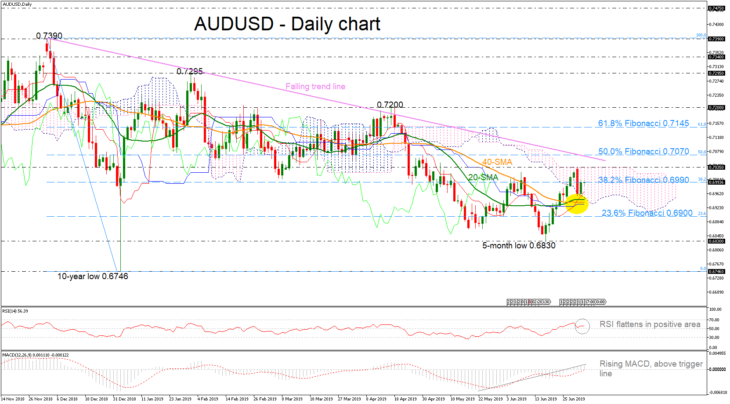

AUDUSD is flirting with the 38.2% Fibonacci retracement level of the downleg from 0.7390 to 0.6746 slightly below 0.7000 and is holding inside the Ichimoku cloud. The pair remained above the 20- and 40-day simple moving averages (SMAs) which are flattening as the price is developing within a sideways channel of 0.6830 – 0.7035 in the short-term.

From the technical point of view, the RSI is flattening in the bullish territory, while the MACD is rising above trigger and zero lines, suggesting a possible upside rally.

In case of more gains, the pair needs to overcome the 38.2% Fibonacci of 0.6990 to meet a key barrier around the 0.7035 resistance, taken from the latest high, near the upper surface of the Ichimoku cloud. The 50.0% Fibonacci mark of 0.7070 could act as resistance too as it overlaps with the falling trend line before a more important battle starts near the 61.8% Fibo of 0.7145.

On the other side, if the price declines below the SMAs, support to downside movements could be initially detected around the 23.6% Fibo of 0.6900. Clearing this area, the next stop could be at the five-month low of 0.6830.

In the short-term picture, the sentiment turned slightly neutral to bullish after the price rebounded on the 0.6830 support. Traders should wait for a jump above the six-month descending trend line before initiating positive positions.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold