Main market themes

- US stocks ended little changed overnight following a rally in the previous session as investors await more trade-related development concerning the signing of US-China deal. The S&P 500 retreated slightly by 0.1%, the Dow rose 0.1% and NASDAQ was flat but stocks remained at all-time highs.

- Treasuries continued to fall as traders ditched safe haven assets amid growing trade optimism leading benchmark UST yields to gain 4-8bps. 10Y UST yield picked up 8bps in a single day to 1.86%.

- USD extended further gains, strengthening against most of its major counterparts, aided by the solid gain in the ISM non manufacturing index, a key services sector gauge.

- Solid US ISM Non-manufacturing reading highlights services sector strength: The ISM Non-manufacturing index added 2pts to register a solid 54.7 reading in October (Sep: 52.6), reflecting an upbeat outlook for the services sector leading up to the holiday season and a firm sign that a strong labour market will continue to support the industry in general. The gain in the headline index was led by the higher activity/production, new orders and employment. On a separate note, the IHS Markit Services PMI however slipped to 50.6 in October (Sep: 50.9) to indicate a slowdown in services activity.

- GBP was the best performer, making gains after a slightly better-than-expected service sector PMI, although the improvement was quite modest. The Markit/CIPS services PMI rose to 50.0 in October from 49.5 in September, whilst the Markit/CIPS construction PMI also came in at a reading of 50.0 in October, following a reading of 49.3 in the prior month. That said, GBP was not immune to the stronger USD tone post-US data.

- Oil prices went up by 1.2- 1.3% on trade optimism.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1025 (1.9b) 1.1150 (653m)

- GBPUSD: 1.2150 716m

- USDJPY: 108.00 (1.5b) 108.75 (780m) 109.20 (485m)

EURUSD (Intraday bias: Neutral: bullish above 1.1150 bearish below 1.1110)

From a technical and trading perspective, 1.1130 support being eroded (daily chart has flipped bearish as per the near term VWAP) this delays the anticipated 1.12 upside objective. As 1.1150 now act as resistance expect a test of pivotal support back at 1.1070 participation at this level will be key for further upside trend development.

EURUSD…UPDATE testing pivotal support a failure to find buyers here and a close below 1.1020 would add to bearish momentum opening a move to test 1.0960. On the day look for resistance at 1.1100/10.

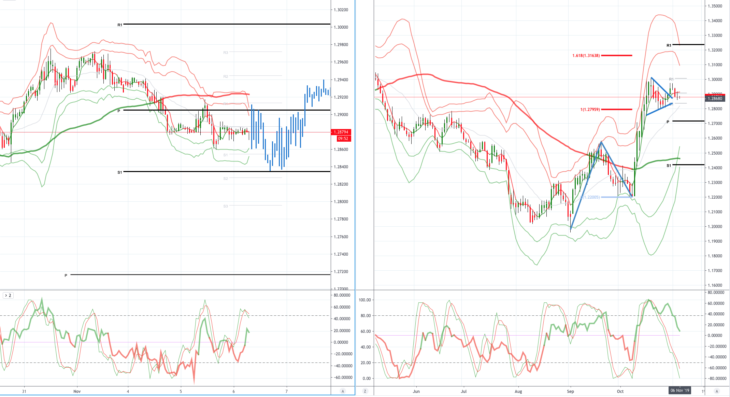

GBPUSD (Intraday bias: Neutral: bullish above 1.2915, bearish below 1.2870)

From a technical and trading perspective, Daily chart has flipped bearish as per the daily VWAP, currently the upside breach of the symmetrical triangle appears to have been a false break, on the day look for a test of 1.2840 to find some initial support, leading to further consolidation in the 1.2840/1.290 area. A breach of 1.2820 would suggest a deeper correction to test pivotal 1.2720. NO CHANGE IN VIEW

USDJPY (intraday bias: Bullish above 108.50 target 109.40)

From a technical and trading perspective, 108.50 failed to acts as resistance, the daily chart has flipped bullish as per the near term VWAP, suggesting further upside potential, with stops above 109.30 eyed. Only a failure below 108.40 would open another test of bids at 108.00. NO CHANGE IN VIEW

AUDUSD (Intraday bias: Neutral Bullish above .6870 Bearish below)

From a technical and trading perspective,initial bullish objective achieved, as .6880 now acts as support look for a test of offers towards .6950 and then stops above. Caution today as daily chart has flipped bearish as per the near term VWAP (note yesterday’s key reversal and second close below the near term VWAP), failure to recapture ground above .6910 could see a breach of yesterday’s low and open a test of pivotal support sited .6840/30.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold