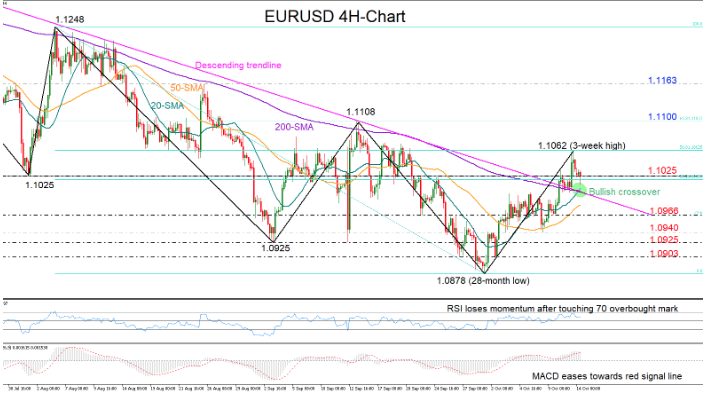

EURUSD rose as high as 1.1062 following the breach of the four-month-old downward-sloping line but the technical indicators signaled overbought conditions, with the price correcting slightly lower and towards the key 1.1025 barrier.

The short-term bias is looking bullish to neutral in the four-hour chart as the RSI is heading towards its 50 neutral mark and the MACD is losing momentum towards its red signal line.

In terms of market trend, the bullish crossover between the 20- and the 200-period simple moving averages (SMA) is an encouraging indication that the upward direction may hold, though a higher high above 1.1108 and a higher low above 1.0878 is technically required to officially violate the downtrend started at the end of June.

A rally above the 1.1062 peak, where the 50% Fibonacci of the downleg from 1.1248 to 1.0878 lies, could help the price to reach the 1.1100 mark and the 61.8% Fibonacci. If buying interest persists above the latter, resistance could then appear somewhere near the 1.1163 barrier.

Alternatively, if the bears keep control under 1.1025, the price could find support around the 200-period SMA which currently touches the downward-sloping line at 1.1000. Further down, the sell-off may stop around the 23.6% Fibonacci of 1.0999 that offered some underpinning last week, while lower, the area between 1.0940 and 1.0925 could prove a stronger obstacle before all attention turns to 1.0900.

In brief, positive momentum in EURUSD may weaken in the short-term, while regarding the market trend, the pair has yet to confirm that bullish trend signals are viable.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold