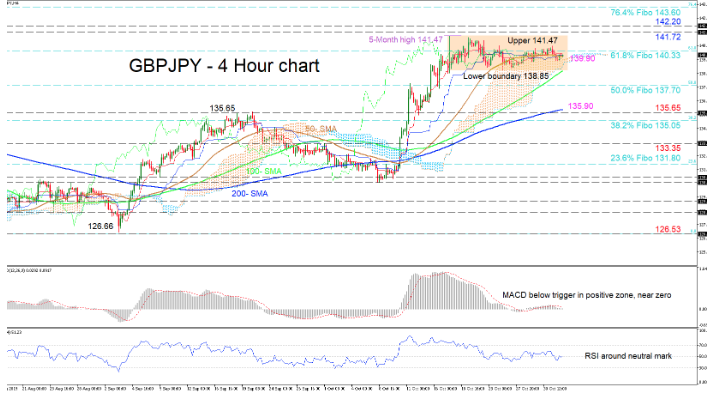

GBPJPY’s directional momentum has disappeared after sellers ceased further gains on October 17, having rallied strongly from October 8. A second attempt higher was denied, shifting the pair into a directionless market, which is also backed by the flat 50-period simple moving average (SMA), Tenkan-sen and Kijun-sen lines.

The MACD, is barely above the zero line but below its red trigger line, while the RSI is reflecting a marginal increase in positive momentum, as it is pointing up at its 50-neutral mark. Despite this, the upward slopes in the 100- and 200-period SMAs support the existing positive picture.

With a current base from the 50-day SMA and the upper band of the Ichimoku cloud, the bulls face a nearby resistance within this range at 140.33, which is the 61.8% Fibonacci retracement of the down leg from 148.86 to 126.53. Next, a more lasting move would be needed, to overcome the downside pressure from the upper boundary of 141.47 (five-month high) and the neighboring resistances of 141.72 and 142.20, to drive efforts to challenge the 76.4% Fibo of 143.60.

Alternatively, if sellers retake the reins and pierce through the cloud, the lower boundary of 138.85 and the 100-period SMA beneath, could be a tougher obstacle to clear ahead of the 50.0% Fibo of 137.70. A further drop could stumble around the 200-period SMA at 135.90 and the support of 135.65 before the 38.2% Fibo is tested.

In brief, the short-term sentiment is neutral-to-bullish above the cloud and a break above 141.47 or below 138.85, would expose the next direction.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold