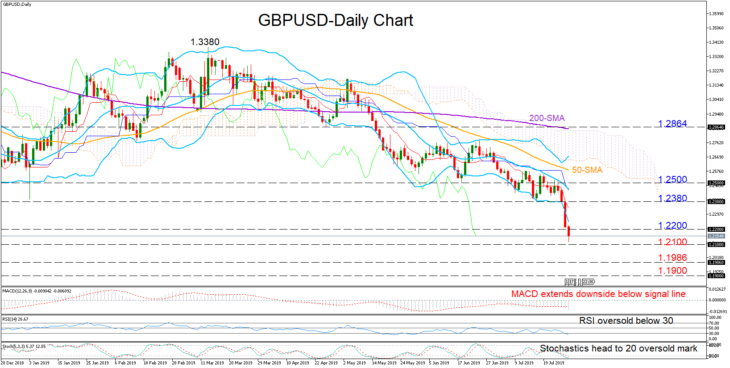

The heavy sell-off in GBPUSD stretched into Tuesday’s session as fears over a no-deal Brexit mounted, with the pair diving below 1.22 and towards its post-Brexit referendum troughs.

The RSI is slipping below 30, the Stochastics are heading towards the 20 level, while the market action is currently taking place under the lower Bollinger band, all flagging that conditions are oversold, and an upside reversal could be around the corner. Yet any recovery could prove short-lived if the MACD continues to strengthen in the negative territory.

The 1.2100 psychological level is now in the spotlight to save the market from additional losses. Should the bears clear that obstacle too, all attention will shift to the 1.20-1.1986 zone, where the market bottomed in early 2017 following the Brexit referendum in June 2016. Any close lower could open the way towards 1.1900.

On the upside, the 1.2200 number could provide nearby resistance. Yet the bearish sentiment is likely to keep weighing unless the price manages to bounce above the 1.2380 barrier. A rally above 1.25 would put the market back to neutrality if the middle-Bollinger band currently at 1.2460 fails to hold, while in the three-month picture (medium-term) a steeper upturn above April’s low of 1.2864 is required for an outlook reversal.

In brief, GBPUSD is strongly bearish both in the short- and the medium-term picture.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold