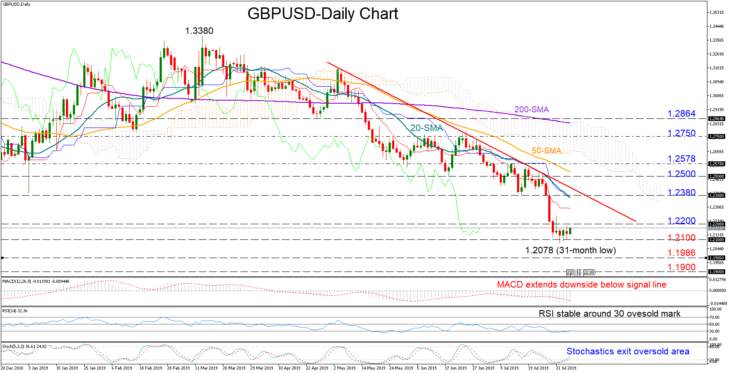

Last week’s aggressive downfall to a 31-month low of 1.2078 turned GBPUSD players indecisive, with the price sliding sideways within the narrow 1.21-1.22 boundaries and well below moving averages afterwards.

Speculations for an upside correction are rising as the fast-Stochastics continue to head north after printing a bullish cross below the 20 oversold mark. The RSI, which hovers around its own 30 oversold level is also suggesting a price reversal. Still, should the MACD show no sign of improvement in coming sessions, bearish forces are likely to dominate in the short-term.

On the way down, the 1.2100 round level could come in test. If the number fails to save the market this time, the downtrend could extend towards the 1.2000-1.1986 zone, where the price bottomed after the Brexit referendum in June 2016. Lower, the 1.1900 mark could also be of psychological importance and therefore should attract attention in case of a steeper fall.

Should bullish pressures return, traders could wait for a close above the 20-day simple moving average and the 1.2380 former support region to maintain buying interest. Moving even higher, the bulls would need to clear resistance between 1.2500 and 1.2578 to stretch buying appetite above the descending line, while further up, another battle could start around the 1.2750 block.

Turning to the medium-term timeframe, the lower lows and the lower highs from the 1.3380 top frame a bearish picture and only a decisive rally above 1.2864 would shift the market back to neutral.

Summarizing, GBPUSD bears could continue to navigate the market both in the short and the medium-term.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold