- Tensions flare up in the Middle East after US air strikes kill Iran’s top military leader

- Oil prices shoot higher, stocks turn negative after the attacks

- Gold hits 4-month high, yen and Swiss franc soar

US air strikes kill risk-on mood

Heightened geopolitical tensions threatened to destroy the risk-on sentiment that’s been driving the markets since December after the United States launched air strikes in Iraq, killing top Iranian military officials. The US Defense Department said President Trump had ordered the strike on Baghdad airport where Iranian Major-General Qassem Soleimani was targeted.

Iran’s Supreme leader Ayatollah Ali Khamenei warned the US of “harsh retaliation” for the killing of General Soleimani, who was considered to be the mastermind behind Iran’s expanding influence in the region as well as for the recent attacks on the US embassy in Baghdad.

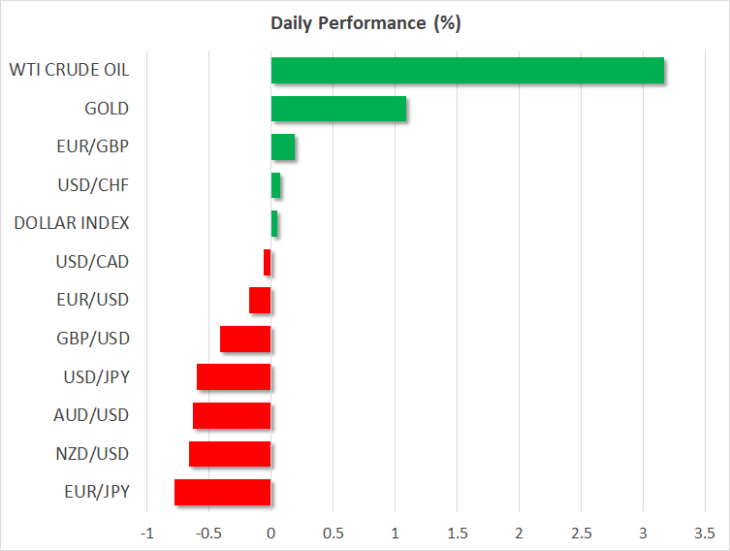

Oil prices surged more than 3% after the attacks as investors feared Iran could respond by launching attacks on oil installations in the region similar to the one that struck Saudi Arabia in September as well as block oil tankers from passing through the Strait of Hormuz in the Gulf.

Brent crude was last trading at $68.37 a barrel, easing slightly from an earlier 3½-month high of $69.16, while WTI last stood at $63 a barrel.

Oil prices have been rallying sharply since October as a combination of the improving outlook for global growth and tighter supply restrictions have boosted the commodity. But a major escalation in the Middle East that severely disrupts oil supply would risk damaging a fragile global economy that has only just started to recover from the long-running trade war between the US and China.

Stocks stumble after hitting fresh peaks

The market mood quickly turned sour as news of the US killing of Iran’s top military man emerged. Stocks in Asia retreated from earlier gains, with China’s CSI 300 index halting its attempt to surpass yesterday’s 2-year high and ending the day 0.2% lower. Equity futures for Europe and the US were also in the red, with the S&P 500 e-mini futures pointing to losses of about 1% at the open.

After a spectacular rally in the fourth quarter where all three major indices on Wall Street regularly recorded fresh record highs, a major crisis in the Middle East could be the trigger that causes a large correction.

However, the relatively contained market reaction today suggests investors are waiting to see how Iran will retaliate and the extent to which tensions will escalate in the coming days or weeks before redirecting their funds into safe assets in significant numbers.

Gold surges leads safe havens higher

For now, the intensifying geopolitical tensions were enough to drive gold to a 4-month top of $1544.88 an ounce. The precious metal is up almost 7% from the trough of $1445 hit in November as, despite easing trade frictions, demand has held up. Seasonal factors and ongoing uncertainties related to Brexit and the trade war, which have not been completely resolved, have supported gold, while a broadly softer US dollar has been positive for prices too.

Other safe havens also benefited from the increased risk aversion with US and German government bond yields tumbling, while the yen and the Swiss franc advanced against most of their major peers.

The dollar fell below the key 108 level versus the yen, though against a basket of currencies, the dollar index was flat as both the euro and the pound lost ground versus their US counterpart.

The Australian and New Zealand dollars were the biggest losers from the deteriorating market sentiment, falling around 0.6% each against the greenback.

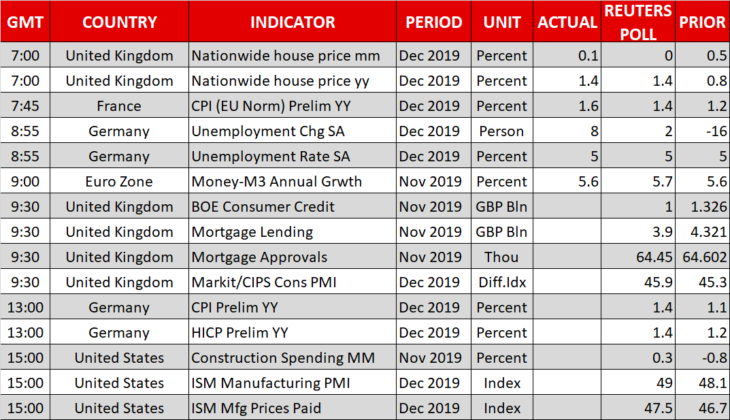

Assuming there’s no further escalation in the Middle East, the focus later in the day will turn to the ISM manufacturing PMI out of the US as well as on the Federal Reserve. The minutes of the Fed’s December meeting are due at 19:00 GMT and Fed speakers will also be making their first remarks of 2020.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold