Oil prices aren’t very high at the beginning of the fourth week of June. Brent is currently trading at 65.39 and has good chances to continue this rise.

The weekly report from Baker Hughes on the rig count showed 967 units, which is 2 units less that before. However, the oil rig count added 1 unit, thus making it 789, which is a bit better that expected. This information is quite neutral for oil prices, because it shows the lack of dynamics in the indicator, although it confirms that the interest in horizontal drilling is going down.

However, the commodity market pays little attention to fundamental news these days. The hottest potato is the Middle Eastern issue, which may push oil prices even higher. Today, market players are waiting for new escalations from the United States towards Iran. Well, at least the US President Donald Trump tweeted about them. He was speaking about more global sanctions. In case it does happen, oil prices may skyrocket very quickly.

Oil bulls are clearly ready to attack, all they need is a trigger.

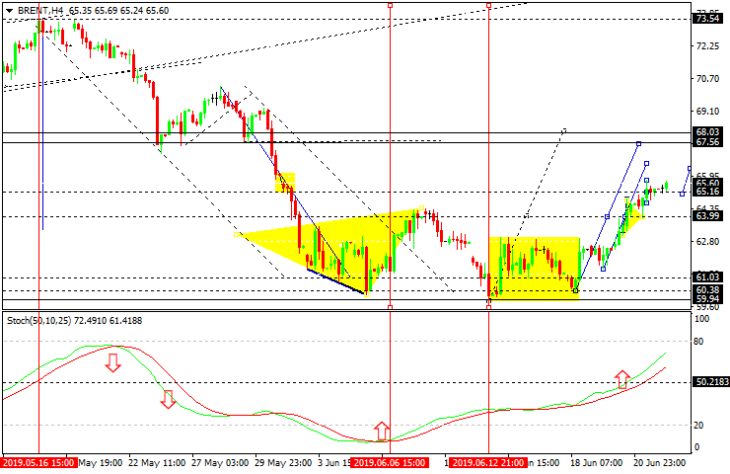

In the H4 chart, Brent is trading upwards and forming Double Bottom near the lows. After breaking 63.00 to the upside, the pair is steadily trading towards 68.00. At the moment, the price is forming the third rising wave with the short-term target at 67.67. From the technical point of view, this scenario is confirmed by Stochastic Oscillator, as its signal line has broken 50 and is currently trading directly upwards, thus indicating a potential of the current ascending wave.

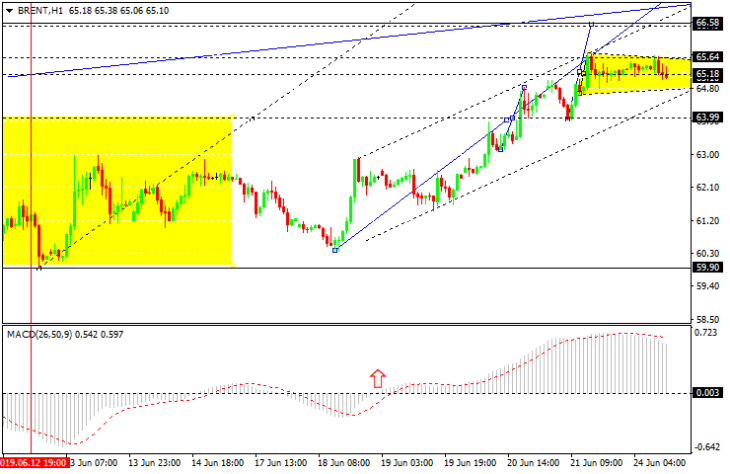

As we can see in the H1 chart, Brent is consolidating around 65.00. If the price breaks 65.60 to the upside, the instrument may continue growing towards 66.60. However, if it breaks 64.60 to the downside, the pair may start a new correction to reach 64.00 and then resume trading upwards with the short-term target at 67.67. From the technical point of view, this scenario is confirmed by MACD Oscillator, as its signal line is no longer trading near the highs. So, the instrument may be corrected towards 64.00 and then resume moving insider the uptrend.

SP500

SP500 FTSE

FTSE FCE

FCE Nasdaq100

Nasdaq100 Russell2000

Russell2000 Index Nikkei225

Index Nikkei225 DOW 30 (DJI)

DOW 30 (DJI) RTS futures

RTS futures RTSI

RTSI DAX30

DAX30 eBay Inc.

eBay Inc. Google Inc.

Google Inc. IBM Corp.

IBM Corp. Microsoft

Microsoft  Apple

Apple Yandex

Yandex Toyota

Toyota Volkswagen

Volkswagen Facebook

Facebook Tesla

Tesla Twitter

Twitter Hasbro

Hasbro Bitcoin

Bitcoin Litecoin

Litecoin BitcoinCash

BitcoinCash Dash

Dash Ripple

Ripple Ethereum

Ethereum EmerCoin

EmerCoin NameCoin

NameCoin PeerCoin

PeerCoin Monero

Monero ETC/USD

ETC/USD Silver

Silver Platinum

Platinum Palladium

Palladium Copper

Copper Gold

Gold